BOOTHBAY — Gov. Paul LePage and his wife, Ann, swung a great deal on the house they bought out of foreclosure in Boothbay last month, according to neighborhood residents and a local real estate agent.

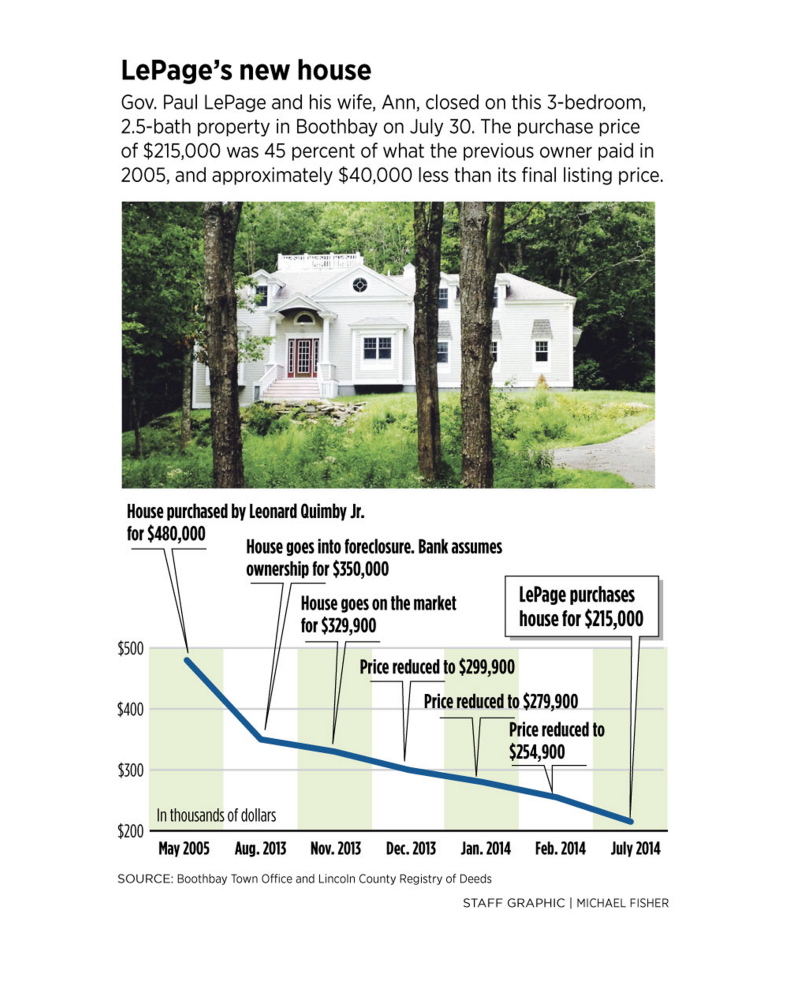

The home at 74 Firth Drive is located in Muirgen, a private development off Back Narrows Road in Boothbay, where house values range from $286,000 to $1.3 million, according to town records. The LePages bought the home for $215,000 from a bank that was asking $329,900 for the property after taking it from its previous owner in a foreclosure proceeding last year.

G. Michael Loewe, a member of the Muirgen Property Owners Association, said neighborhood reaction to the LePage purchase will be mixed.

“There are probably some people in the association who are thrilled and others probably feel more like me,” said Loewe, who noted Tuesday that he’s “not fond of the governor.”

“But I do know this,” he said. “They got an excellent deal.”

The average house value in Muirgen is about $700,000, and the town assesses the LePages’ home at $453,000 — more than twice what they paid.

The house had been foreclosed on in August 2013 with an outstanding balance of $350,000. The original listing by the bank was $329,900 in November 2013. Then it dropped to $299,900 a month later and to $279,900 in January 2014.

The final listing price was $254,900, which was still about $40,000 above the price the LePages paid.

Bruce Tindal, owner of Tindal and Callaghan, a leading real estate firm in Lincoln County, is familiar with the Muirgen development and agreed that the LePages got a very good deal on the house.

“I think it was a bit of a sleeper,” he said. “It had been in foreclosure for years and it just sat and sat.

“What the LePages paid was probably rock bottom, but I think the bank was probably glad to be rid of it.”

TOO GOOD TO PASS UP

Muirgen is a few miles from the center of town. One side of the development abuts the mouth of the Damariscotta River and offers ocean access. The other side, where the LePages bought, does not border the water, but the owners have access and each has a deep-water mooring.

The development is home to a mix of mostly wealthy out-of-state residents and retirees.

Jane Arsenault, the current president of the property owners association, and her husband, Raymond, are both.

They live in Rhode Island but spend summers in Boothbay.

“We built the house six years ago with an eye toward retirement,” she said.

That is probably what the LePage’s have in mind as well.

Ann LePage said last week that she and her husband had been looking for coastal property for some time. The Boothbay home was a deal too good to pass up.

This is first time in four years the LePages will have paid property tax in Maine, although Gov. LePage’s signature is not on the deed or the mortgage documents. His campaign spokesman, Alex Willette, would not comment on why the house is only in Ann LePage’s name. The property taxes on the Boothbay house were $3,477 in 2012.

The couple also owns a house near Daytona Beach, Fla., where Ann LePage and her mother spend a significant amount of time in the winter.

The LePages previously owned a house in Waterville, where they lived for many years before selling the property in 2010 after LePage was elected governor.

How soon the couple moves to Boothbay might depend whether LePage wins re-election in November.

But Arsenault got a call from Ann LePage shortly after the sale was finalized.

“We welcomed them to the association like we would anyone else,” Arsenault said.

In fact, Arsenault extended a standing invitation to the LePages to a members’ dock party the association throws on Friday nights.

“We’re all pretty close-knit here,” she said.

ORIGINAL COST: $480,000

The LePages’ two-story colonial style home was built in 2003. County records list the first owner as Leonard Quimby Jr., who bought it in May 2005 as a vacation property for $480,000.

Tindal, the real estate agent, said that price reflected the height of the market in Boothbay.

The home has three bedrooms, two full bathrooms and one half-bath in about 2,200 square feet.

Quimby and his family did not appear to spend much time in Boothbay, according to neighbors.

When the bank, HSBC USA, foreclosed on the property in August 2013, there was $350,000 left on the loan, according to town records.

Quimby could not be reached for comment Tuesday. Public records indicate he has had recent addresses in Chicago and Phoenix.

Although the purchase price of the home was $215,000, the LePages’ mortgage, through Kennebec Federal Savings and Loan, was for $172,000, according to documents filed with the Lincoln County Registry of Deeds. The interest rate was not disclosed in those documents, but the mortgage has a 15-year term, rather than the conventional 30 years.

The interest rate Tuesday on a 15-year residential mortgage loan through Kennebec Federal Savings and Loan was 3.25 percent, according to the bank’s website.

Foreclosed homes often can be the best deals in real estate. When a bank assumes ownership of a property, it usually wants to unload it as soon as possible to avoid losing any more money and so it doesn’t have to maintain the home while it’s on the market.

At the end of June, Maine’s 31 state-chartered banks and credit unions held about 64,000 first-lien mortgages and 239 were in the process of foreclosure, according to the Maine Bureau of Financial Institutions.

That represents a continued drop in the rate of foreclosure in Maine since the real estate bubble burst. In 2011, the number of initiated foreclosures in Maine was 375. In 2013, that dropped to 267.

Those numbers do not include national banks, such as HSBC, the bank that owned the LePage’s home.

Foreclosure purchases sometimes come with risks, however, and often need a little more TLC than traditionally marketed homes.

Both Tindal and Loewe said the house probably will require some work since it has been vacant for so long.

If the LePages put a significant amount of work into the house, it probably would need to be re-appraised.

They also might incur another added expense.

Loewe said the association is looking into re-paving the road through the neighborhood, which is not owned by the town.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.