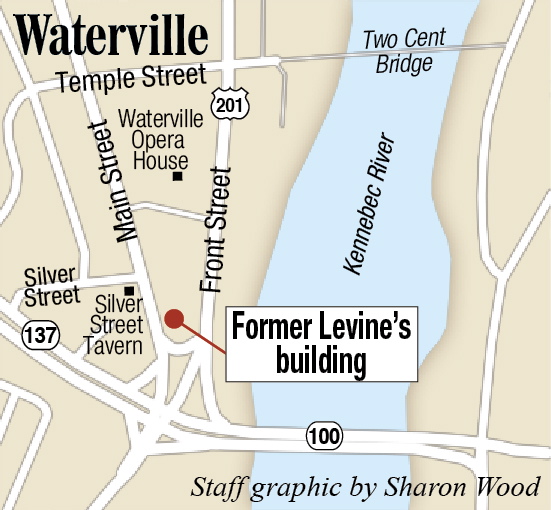

WATERVILLE — Plans to renovate the former Levine’s clothing store on Main Street downtown have collapsed because of disagreements between the building’s owner and the city about an application for a city loan to pay part of the cost.

Michael Soracchi of Milford, Conn., bought the building for $70,000 and claims to have spent $92,000 on the property to date, including renovating apartments on the upper three floors and retail space at street level. Soracchi said he won’t move forward without the loan.

“I will do something when the city presents me an offer to accept or decline, but I’m not applying for anything else with the city,” Soracchi said.

City Manager Michael Roy said Soracchi failed to meet deadlines for providing documentation needed for the loan. As a result, Roy said, the city has walked away from the project.

“This case is closed, and we will not be considering anything further from Mr. Soracchi,” Roy said.

Soracchi applied under the city’s Downtown Forgivable Loan Program through the city in April 2013, but the loan has never been made. Funding would come from the city’s downtown tax increment financing fund. Under the loan program, a borrower makes interest-only payments and the principal is forgiven if pre-established conditions are met.

Roy said the city considers Soracchi’s loan application closed because he did not submit all the financial paperwork required and was consistently late with all of his submissions. As a result, the city did not have confidence that Soracchi has the ability to complete the project.

Soracchi said the city delayed the loan process for more than a year, which prompted him to decide to spend his time and money elsewhere.

“The city didn’t do what it promised in a timely manner. Consequently, other projects have a better return on my investment,” Soracchi said.

He said he will not continue working on the building unless changes are made.

The city manager said he made repeated attempts to get Soracchi to provide information about the project.

After Soracchi applied for the loan in April 2013, he did not submit 2012 tax information, as city officials required, until fall, according to Roy. He emailed Soracchi on July 15, asking him to respond to the Kennebec Valley Council of Governments by Aug. 13, Roy said. KVCOG helps administer the loan for the city.

Soracchi, who said the complexity of his finances requires that he obtain extensions for filing his federal tax returns, missed that city-imposed deadline. As a result, Roy said, KVCOG did not review his full application until Oct. 3, more than six weeks after the deadline.

A person working on the paperwork at KVCOG left that organization, and the city contacted Soracchi shortly after that to tell him the city needed additional information about his plans for financing the project, according to Roy.

On Nov. 21, Roy wrote to Soracchi, asking for additional proof of financial capacity, including information about what collateral Soracchi had to back up the loan. A borrower must have property or equipment worth an amount equal to or greater than the amount the city lends him, so that if there is a default, the city can recover the amount borrowed, according to Roy. He said the borrower is required to sign mortgage-type forms, which gives the city ownership of the property in the event of default.

Roy said Soracchi did not respond to his request until Jan. 30.

“At that point, we told him we needed 2013 tax information, which he never produced,” Roy said.

Soracchi said he did not produce that information because he had filed for an extension with the IRS on his 2013 taxes, which were still in the process of being prepared.

“We’re not going to give out $25,000 unless we have first position on real estate or equipment in that amount or greater,” Roy said Tuesday in an email. “He never supplied information to allow us to determine that. Filing a request for an income tax extension is not even close to giving us a picture of his financial capacity.”

According to documents recorded at the Kennebec Registry of Deeds, Soracchi has no mortgage on the property, and the only lien is for an unpaid city property tax bill that Soracchi disputes.

Roy said the use of the property as collateral would have to be analyzed by a loan underwriter, “but we were never able to get to that point.”

A letter to Soracchi from Roy, dated July 14, 2014, said all loan applicants are required to submit the same financial information and set a deadline submitting the requested information: “This financial information is the same as that noted in my letter of March 31 … a letter that you did not respond to until late May and that was only after repeated phone calls from Jen Olsen (executive director of Waterville Main Street, which helps administer the loan) at Waterville Main Street. Please be advised that if the required information is not received by Aug. 1, the city will consider your application closed.”

The Forgivable Loan Program’s requirements also include submitting copies of tax returns each year and providing financial statements.

The city’s tax collector, Linda Cote, said Monday that the city has a $4,345 property tax lien on the property. If the taxes are not paid by February 2016, the city would foreclose on the building, she said.

Soracchi said the reason he has not paid the taxes is that the city has it assessed at a much higher value than what it actually is worth. Soracchi said he has an attorney working on that issue and when it is resolved, he will pay his taxes.

“I paid $70,000 for the building, which is assessed at $150,000,” he said. “That building was on the market for three years and they couldn’t sell it, so what I paid for the building is market value.”

Amy Calder — 861-9247

Twitter: @AmyCalder17

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.