An Augusta widow’s bid to force the state retirement system to pay a life insurance claim on her dead husband is now in the hands of an independent arbitrator.

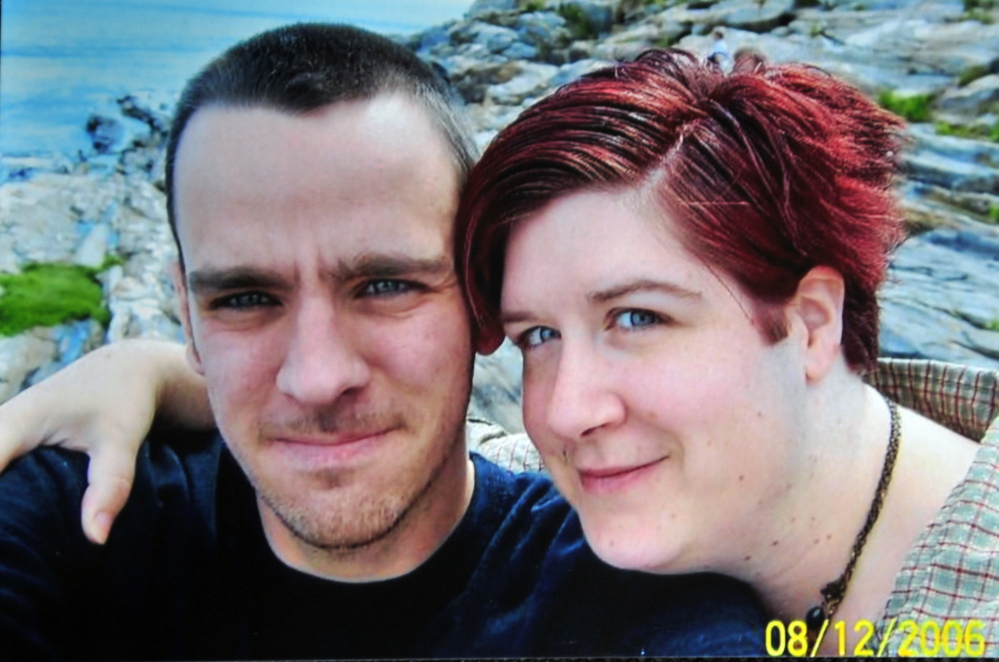

Jennifer Neumeyer and her attorney, Daniel Dube of Lewiston, were granted a hearing earlier this week to appeal a decision by Maine Public Employees Retirement System to deny payment of a life insurance policy the family believed was held by her husband, Scott Neumeyer, who was 35 when he died of pancreatic cancer in December.

But the policy was canceled in 2011 because of a skipped payment. The state says that cancellation was accompanied by a letter sent through the mail. Jennifer Neumeyer claims that letter never arrived.

“The crux of the argument is there was not proper notification,” Dube said. “They have a letter of notification. I call it a nice draft. There’s no record of issuance and no record of receipt. This whole case could have been avoided for $3 in certified mail.”

Neumeyer, 44, learned shortly after her husband’s death about the cancellation, which happened when the Neumeyers missed a payment while Scott was out on extended sick leave in 2011.

Neumeyer has appealed the state’s decision to withhold the roughly $120,000 payment.

John Milazzo, general counsel for the retirement system, said he could not comment specifically on Neumeyer’s case, but that the system will accept the arbitrator’s decision unless there is an error of law or unless he somehow exceeds his authority.

“It’s really out of the system’s hands,” Milazzo said. “It’s in the hands of the hearing officer.”

The process could take a couple of months.

In the meantime, Neumeyer continues to work for the state as a secretary for the Maine Bureau of Parks and Lands, but is scrambling to provide for herself and her daughter, 13-year-old Colleen. She continues to live in the house they shared with Scott, but she can’t make rent payments on her salary. Neumeyer has said the property owner is letting them live in the home “out of generosity.”

Scott Neumeyer had a number of health maladies that started cropping up in early 2001. He was hospitalized several times for an unidentified sickness until doctors determined he had an aggressive form of ulcerative colitis. He was subsequently diagnosed with diabetes.

Neumeyer has said 2000 was the last year her husband’s body functioned properly.

Scott Neumeyer, an office assistant with the Maine Department of Labor when he died, started workingfor the state in 2003. What is undisputed by the state or Jennifer Neumeyer is that Scott signed up for life insurance when he took the job with the state.

That policy, for $120,000 and equal to three times his yearly salary, became active on Jan. 1, 2004. The premiums were taken automatically from his paycheck.

That process was interrupted, however, in June 2011 when Neumeyer broke a femur when he slipped and fell while running across a wet parking lot. He was out of work for an extended period and missed at least one paycheck, Jennifer Neumeyer said. Missing work interrupted his health insurance payments, which also came out of his paycheck automatically. The health insurance company notified the Neumeyers of the disruption, and the Neumeyers paid $1,300 to bring the policy back up to date.

The Neumeyers didn’t know the missed paycheck also affected his life insurance policy, Jennifer said.

Milazzo said in May that the policy was still active in July 2011 when the Maine Public Employees Retirement System received notice that Scott Neumeyer was out on unpaid health leave that began in mid-June.

The retirement system sent a bill to the Neumeyers’ home on Aug. 1, 2011, requesting a payment of $9.60.

“The notification stated that the premiums were due by Aug. 15, 2011,” Milazzo wrote in a letter rejecting Jennifer Neumeyer’s initial appeal.

Jennifer Neumeyer said they never received that letter or a second the retirement system claims it sent to inform them of the policy cancellation. The retirement system, which confirmed it had the correct address, said there is no indication the letters were returned as undeliverable.

“I got a letter for health insurance for $1,300 and I paid it,” Jennifer Neumeyer said in May. “Why wouldn’t I pay one for $9.60? It doesn’t make sense.”

Dube said when he asked MPERS to mail him documents to help him prepare for Tuesday’s hearing, they mailed it to the wrong address.

“Where did the envelope go originally? It didn’t go to me,” he said.

Dube noted that MPERS sent the letter rejecting Neumeyer’s initial appeal by certified mail, which she did receive.

“They appear to take great care of sending out their denials, but not their notifications of terminations,” Dube said.

He argued at the hearing that there was compelling evidence that MPERS should “turn back the clock,” which would allow Neumeyer to essentially reactivate her husband’s life insurance by paying the back premiums and a reinstatement fee, a total Dube estimated would be a few thousand dollars. The state would then pay out the active policy.

“They have the power to do that,” Dube said. “There is justification to do that.”

Craig Crosby — 621-5642

Twitter: @CraigCrosby4

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.