SOUTH PORTLAND — Tucked beside the Maine Turnpike, across from the Maine Mall, is the site where Resort Lifestyle Communities plans to build its version of senior citizen nirvana.

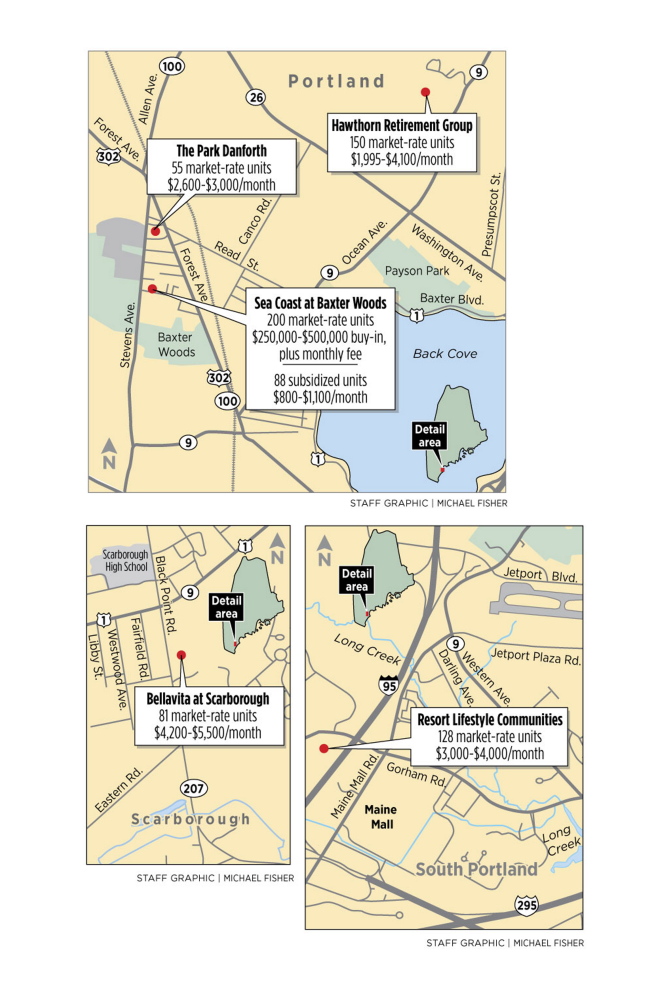

The 128-unit housing complex would feature fully equipped luxury apartments, social programs and shuttle service, along with a pharmacy, bank, hairdresser, gift shop, health club, movie theater and two restaurants offering 24-hour casual or fine dining. All-inclusive rents would range from $3,000 to $4,000 a month, depending on the number of bedrooms, with a $600 monthly fee added for a spouse or other secondary resident.

“It’s kind of like a cruise ship on land,” said Josh Thornton, vice president of development at the Lincoln, Nebraska, company. The land – nearly 10 acres off Running Hill Road, next to the Fairchild Semiconductor plant – is under contract but still listed at $4.5 million.

The Resort Lifestyle proposal is one of five market-rate, 55-plus housing projects that are planned or under construction in Greater Portland. Each of them answers part of a growing need that’s fueled by Maine’s rapidly aging population. And the developers expect to fill their units, despite Maine’s status as a relatively poor state where many seniors have limited financial resources.

“It only takes 128 people to fill (the complex) and there are far more (people) than that in Maine who can afford to live in our community,” Thornton said. His company uses an in-house computer program to analyze demographics and decide where to build. Resort Lifestyle – with its slogan, ‘Retire comfortably. Live luxuriously.’ – operates 10 communities across the country and it’s developing several more.

The high-end boom in Maine stands in stark contrast to the small amount of subsidized rental housing that’s being built for low- to moderate-income seniors. While market-rate projects in the Portland area are expected to produce at least 614 units in the next year or so, three state- and federally subsidized projects – in Portland, South Portland and Gorham – will create a total of 156 units with monthly rents between $800 and $1,200.

The imbalance comes as affordable housing advocates wrangle with Gov. Paul LePage over a bipartisan $65 million bond bill that would help build 1,000 units of subsidized senior rental housing across Maine.

LePage, a Republican, questions a recent study by the Maine Affordable Housing Coalition that found an immediate need for 9,000 senior housing units. LePage also opposes the bond bill as a funding mechanism, saying that the Maine State Housing Authority should continue “the balanced approach they are taking already with the resources they have.”

But the authority’s efforts have been flagging in recent years, in part because LePage refused to sign certain federally backed, tax-exempt bonds that could have been issued by the authority in 2011 and 2012, when interest rates were low and contractors were hungry for work. The authority has subsidized construction of about 120 new senior housing units per year over the last six years, and only 47 are expected to be built next year.

Without the $65 million bond bill, the authority can do little more than dent the growing demand for subsidized senior housing, industry experts say. And while no one disputes the need for additional market-rate senior apartments – especially in a state with the highest median age and the largest proportion of baby boomers – housing advocates are increasingly concerned about the lack of subsidized senior housing development and the governor’s opposition to the bond bill.

“(LePage is) in denial of the demographic trends,” said John Wasileski, one of Maine’s top senior housing developers. “With the demographic bulge that’s coming, there will be a growing need for senior housing of all kinds.”

New data from the Maine Real Estate Managers Association, which represents housing providers, bolsters Wasileski’s concern. There are 8,975 senior households currently on waiting lists for subsidized apartments across the state, according to Sherrin Vail, the group’s president.

“We speak to people every day who are on the waiting lists. We know the level of need firsthand,” said Vail, who is property management director at Avesta Housing in Portland. “If we don’t address the need now, the number of people who are in dire need today, living in sub-par housing, struggling to pay rent and buy food, is only going to grow.”

OPENING THIS SPRING

Apartment reservations are going fast at Bellavita at Scarborough, one of the high-end senior housing projects in Greater Portland. The 81-unit apartment complex on Black Point Road, just off Route 1, is due to open this spring. It’s the first foray into Maine by Brookdale Senior Living Solutions, the nation’s largest senior housing developer, which operates more than 1,150 retirement communities across the United States.

Bellavita’s monthly rents will range from $4,200 to $5,500 for independent living, assisted living or dementia care, with related medical care raising rates as high as $10,000 per month, said Melissa Craig, executive director. The maintenance-free apartments are available for month-to-month rental and include all meals, a movie theater, hair salon, shuttle service and social programming. About one-quarter of the units have been reserved.

“Most of my people are coming from Scarborough and Greater Portland,” Craig said. “It’s going fast.”

Among Bellavita’s future residents are Gail and Salvator Catanzaro, parents of Ruth Hughes, who lives in Scarborough and runs a preschool there. The Catanzaros currently live at the Woods at Canco, an independent living community in Portland. Both in their 80s, they moved to Canco after Salvator fell and suffered a brain hematoma that has caused mounting health issues, including dementia. Gail, a retired nurse, is his primary caretaker.

“It’s slowly getting more difficult for her to manage,” Hughes said. “She can’t leave him alone at all now. I want her to have more help and be able to do things on her own.”

Hughes said Bellavita is ideal because it’s near her house, her mother is familiar with Scarborough and she’ll be able to spend more time with Hughes’ three children. Her parents can afford to live at Bellavita largely because her father has a good pension from his career as a social worker in Connecticut public schools. He also has assisted living insurance arranged by Hughes’ husband, John, who is a financial adviser.

“Bellavita costs a little more than Canco,” Hughes said, “but with the assisted living insurance, Bellavita is actually going to be a little less.”

Other market-rate senior housing projects in the region include Wasileski’s 200-unit Sea Coast at Baxter Woods on Stevens Avenue, a 150-unit Hawthorn Retirement Group project on outer Ocean Avenue and a 55-unit expansion of The Park Danforth on Stevens Avenue, all in Portland.

WAITING FOR HOUSING

Raoul Paradis cannot afford market-rate senior housing, so he’s on a waiting list for subsidized housing.

Paradis, 62, is a former truck driver and land surveyor who’s dealing with mounting health problems related to advanced diabetes, including neuropathy, blindness and kidney failure. He lives with his brother and sister-in-law in Kennebunk, paying them $475 in rent from his $844 monthly Social Security benefit. But they’re planning to sell their house and move to Florida soon, so Paradis hopes to find a subsidized apartment in the Biddeford-Saco area or near Portland.

“I’m starting to lose faith because I’ve been on a waiting list for years,” Paradis said during a recent four-hour dialysis treatment. “Pretty soon I’ll be staying at a homeless shelter in Portland because I can’t afford to pay rent and I’ve got nowhere else to go.”

Three subsidized senior housing projects are under construction or planned in the Portland area – the 44-unit Ridgeland Gardens by the South Portland Housing Authority, Avesta Housing’s 24-unit Ridgewood II in Gorham, and Wasileski’s 88-unit convent conversion on Stevens Avenue in Portland.

To help thousands of seniors like Paradis, housing advocates say Maine needs the bond bill proposed by House Speaker Mark Eves, D-North Berwick, and Sen. David Burns, R-Whiting. Without it, it’s possible that little new subsidized senior housing will be built.

Over the last six years, the state housing authority has helped to fund an average of 120 senior housing units annually. It has done so by offering developers a combination of low-income housing tax credits, low-interest loans funded through the authority’s bond issues and about $10 million in subsidies funded by a 2009 legislative bond issue that ran out this year.

The subsidies typically fund about 30 percent of a developer’s capital and construction costs, closing the gap between what developers can afford to invest and what they can afford to borrow. The only subsidized senior housing project that’s expected to be built in Maine next year is the 47-unit Hodgkins School conversion in Augusta.

“Developers say the subsidy is necessary to make the math work and make projects viable,” said Peter Merrill, deputy director of the state housing authority. “The tax credits limit the rents that can be charged and the subsidy makes up the difference.”

Without a subsidy, there’s little incentive for developers to turn away from market-rate demand, and without the $65 million bond, there’s little hope that the authority will be able to fund as many senior housing projects as it has in the past, let alone meet the growing need.

“If there’s a market for a particular type of housing, developers will build it,” said Greg Payne, a development officer at the nonprofit Avesta Housing and executive director of the Maine Affordable Housing Coalition.

“In order to create housing and keep rents low, you need a subsidy,” Payne said. “The only reason the authority was able to build as much housing as it has over the last several years is because the (2009 legislative) bond was there. Now that’s gone. What’s going to be done in the future?”

NEED IS GROWING

LePage disputes a recent coalition report that says Maine needs 9,000 units of subsidized rental housing for seniors now, and as many as 15,000 units by 2022 if little is done to address the growing demand. LePage said the number is likely inflated because the study counted Mainers age 55 and older – the eligibility range for most senior housing. However, a 2011 report by the state housing authority projected a similar need – 8,200 housing units for Mainers age 65 and older by 2015. Then there’s the new tally of 8,975 seniors on waiting lists from the Maine Real Estate Managers Association.

Maine’s need for senior rental housing is so great, in part, because its older population is growing fast, has limited financial resources and is living in older housing stock that is spread across a mostly rural landscape.

Maine has the highest median age – 43.9 years – and the second-highest proportion of people age 65 and older – 17.7 percent. Only Florida’s is higher at 18.6 percent, according to the U.S. Census. Maine also has the nation’s highest proportion of baby boomers – 29 percent of its 1.3 million residents were born between 1946 and 1964 – and they’re turning 65 at a rate of 18,250 a year, according to AARP Maine. By 2030, more than 25 percent of Mainers will be 65 or older, magnifying the already serious challenges facing seniors and their communities.

Social Security is the only income source for about one-third of Mainers age 65 and older, according to an AARP study. Many seniors are paying too much to live in homes that exceed or don’t meet their needs, are difficult and costly to maintain and are far from community centers, senior advocates say.

As a result, many older Mainers are isolated from friends and loved ones, subject to debilitating falls and illnesses, and more likely to wind up in assisted living facilities or nursing homes that increasingly depend on Medicaid and Medicare.

State housing officials don’t dispute the existing and growing need for senior housing.

While John Gallagher, director of the state housing authority, issued his own statement last month supporting LePage, he subsequently acknowledged that there’s enough demand in Maine now to warrant building several thousand units of subsidized senior housing.

“The ($65 million) bond issue would be able to do maybe a thousand,” Gallagher said. “And that doesn’t solve the problem. At best, it’s a down payment.”

Gallagher said the authority would do its best to continue promoting subsidized housing development in a balanced way, as the governor suggested, also considering the needs of families and disabled Mainers. If the proposed bond bill were approved, Gallagher said, that task would be a lot easier.

“My approach is to be straight and honest with folks,” Gallagher said. “The political issues are for folks to work out at the State House.”

BOOMER-DRIVEN DEMAND

John Wasileski’s company is developing one of the larger senior housing projects in the Portland area. Sea Coast at Baxter Woods Associates plans to buy Catherine McAuley High School on Stevens Avenue, build 200 market-rate units on the property and convert a former convent into 88 subsidized units. The high school would have a long-term lease for its building.

The market-rate units would sell for $250,000 to $500,000, plus a monthly fee for utilities and other services. The subsidized units, funded with a combination of low-income housing and historic preservation tax credits, would rent for $800-$1,100 a month for income-eligible tenants.

Wasileski knows both ends of the senior housing spectrum and the residents he’s targeting. He started his career in low-income housing development, then built OceanView at Falmouth and The Highlands of Topsham, both sprawling market-rate retirement communities. He sold the latter last month.

Demand for his market-rate properties is strong, Wasileski said, with about half of his residents coming from Maine and half coming from out of state. And all of them are financially secure.

“They’re on Social Security, their homes are paid off and they’ve saved two- to two-and-a-half-times the value of their homes in retirement assets,” Wasileski said. “Those who don’t live here already are coming to be near their children and grandchildren.”

Wasileski worries about other Mainers who don’t have the same resources. Many baby boomers are retiring without the hefty pensions of their predecessors, they have little in savings or assets and those who have retirement accounts lost several years of appreciation during the recent recession.

He believes the governor and others who may oppose the $65 million bond bill are ignoring the demographic trends facing Maine.

“The reality is that many baby boomers are going to crash economically and become more dependent,” Wasileski said. “The bond issue would allow the state to leverage many more units to address the growing need.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.