SKOWHEGAN — The Skowhegan Board of Assessors on Thursday denied a request from Sappi Fine Paper North America to cut the property tax value of its paper mill on U.S. Route 201 by more than $137 million, which would have resulted in the loss of $2.3 million in revenue for the town.

The vote was 3-0 and came after a recommendation by Skowhegan’s assessor’s agent Bill Van Tuinen to deny the request.

Van Tuinen told the board that several components of the company’s abatement request made him “substantially less than convinced” that Sappi’s appraised value was the correct value.

“I don’t recommend that you accept this appraisal as the basis for the abatement that is requested,” Van Tuinen told the board after two closed-door sessions Thursday afternoon with company representatives.

Van Tuinen, assessors, representatives of the mill and attorneys have addressed various methods of figuring out what the mill is worth in multiple meetings. Most of the sessions, including part of Thursday’s meeting, were held behind closed doors because of laws protecting the confidentiality of some company information.

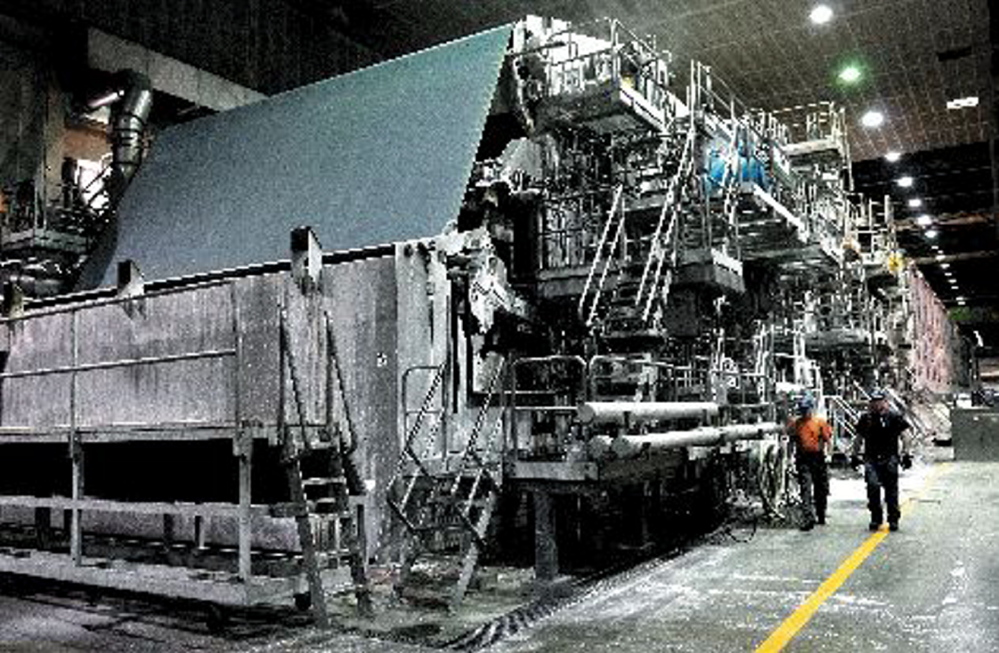

The paper mill is assessed for taxation by the town at $463,630,900. The company claims the property should be taxed based on a value of $326,343,426. The difference — the amount by which the company says the valuation needs to be cut — is $137,287,474. Sappi’s estimate of the mill’s value is based on a study by a Duff & Phelps Corp., a New York valuation firm.

Town Manager Christine Almand has estimated that Skowhegan could face refunding $2.3 million in property tax overpayments if Sappi prevailed in its bid for a further cut in the mill valuation retroactive to last April. The town already has collected the full tax bill from Sappi.

In a prepared statement Thursday, company officials said they appreciate the time and effort invested by Skowhegan officials, but they are disappointed by the board’s decision to deny the abatement request and will appeal the decision to the local Board of Property Tax Review.

“Sappi remains confident in its position and in the appraisal of the Somerset mill conducted by its third-party consultant,” the statement reads. The statement also notes that “the company remains open to working with the town while the appeal is pending to reach an amicable resolution to its abatement request.”

Some of the differences in property values for taxation offered by the town and by Sappi were “gigantic,” Van Tuinen said. He said there was plenty of middle ground between the company’s assessed value and that of the town’s, but the board “denied the abatement in full.”

In setting the valuation, factors such as the value of property that is legally exempt from taxation and the obsolescence of some equipment is considered. Van Tuinen said he disputes the values to those categories as assigned by the valuation firm hired by Sappi.

“I questioned their not adjusting the exempt property in the same relationship as their overall appraisal and how that compared to our appraisal,” he said after the unanimous vote. “I thought they double-counted some obsolescence. I thought they overestimated some obsolescence. They didn’t have enough value on a few taxable inventory items such as spare parts.”

Joanne Woodard, of Skowhegan, the lone resident at Thursday’s meeting, said she was happy with the board’s decision.

“There are a lot of seniors in Skowhegan, and we just can’t afford it any more. I’m a senior myself,” Woodard said. “If my taxes go up because we have to give an abatement for another corporation, it’s going to hurt everyone, not just me. You have to remember that Skowhegan has a hospital that doesn’t pay taxes, and they use one-third of our sewer service. We can’t give anything away to corporations.”

Four meetings have been held this month on the issue of the fair market value of the mill for tax purposes. Maine law provides that property taxes must be based on the fair market value of a property.

Almand said the requested abatement would have meant the town paying a $2.3 million rebate, or refund, to the company for taxes already paid if the full request had been granted. The municipal budget adopted by residents at last year’s Town Meeting came in at nearly $9 million. With county taxes and the town’s share of the school budget, the total budget for this fiscal year is about $21 million, Almand said.

The Board of Selectmen would have had to make changes to include a reduction in services, higher taxes and a possible tax anticipation note to pay its bills while waiting for tax payments to come in, she said. Selectmen also could have tapped surplus accounts, which hold about $3.9 million.

“I knew last year going into this that this process could potentially take two and a half years, so we’re still in a waiting phase,” Almand said. “It could be over. However, there’s a potential that it’s not over. The appeal could be the next step of the process.”

Almand said the Sappi paper mill is very important to the town of Skowhegan. The company pays about 48 percent of the taxes in Skowhegan and employs hundreds of area residents.

Sappi filed a formal property tax abatement application in March with the town’s Board of Assessors, asking that the town lower its property valuation

The request, filed by S.D. Warren Co., a subsidiary of Sappi and the legal owner of the property, followed months of negotiations between the town and the mill that last September resulted in a $100 million cut in the tax valuation of the mill.

Sappi claimed that reduction was not enough to reflect actual diminished value of the mill. Last year, Sappi paid $9.3 million in property taxes.

The previous reduction in the mill’s value, from $567 million to $463 million, approved by assessors last year, cut its tax bill to $7.94 million, or about 48 percent of the town’s total property tax revenue.

Sappi’s appeal process begins with the local Board of Property Tax Review, whose decision could be appealed to a state board and ultimately to a Superior Court judge.

The state Board of Assessment Review is charged by Maine statute with independently reviewing appeals of property assessments or abatement requests that have been denied by the local Board of Assessors and the local Board of Property Tax Review. The appeal must be brought by the property owner. The state board is not a permanent sitting panel. Its membership is drawn from all over the state when needed.

Decisions of the Board of Assessment Review can be appealed to Somerset County Superior Court, which considers the record presented to the board and does not hold a new trial.

By law, the Skowhegan Board of Assessors’ decision must be submitted in writing. Attorney William Dale, who represented the board during discussions with Sappi, said he would compose a draft of the decision and have it ready by 4 p.m. April 30.

Doug Harlow — 612-2367

Twitter: @Doug_Harlow

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.