Legislation that will require the state to bolster its notification process when canceling a life insurance policy became law last week even as the family who prompted the bill has been dealt a setback.

The new law requires the Maine Public Employees Retirement System to provide notices of life insurance cancellations not only to the policy holder but to a designated third party. The law mirrors what private insurers are required to do when canceling an individual life insurance plan.

Rep. Donna Doore, D-Augusta, who submitted the legislation, said the law will add a measure of protection for families.

“When someone is caring for a sick loved one, everyday life can be kind of a blur,” Doore said. “Adding the extra protection of sending a cancellation notice to a third party could be the only way anyone notices a lapsing policy.”

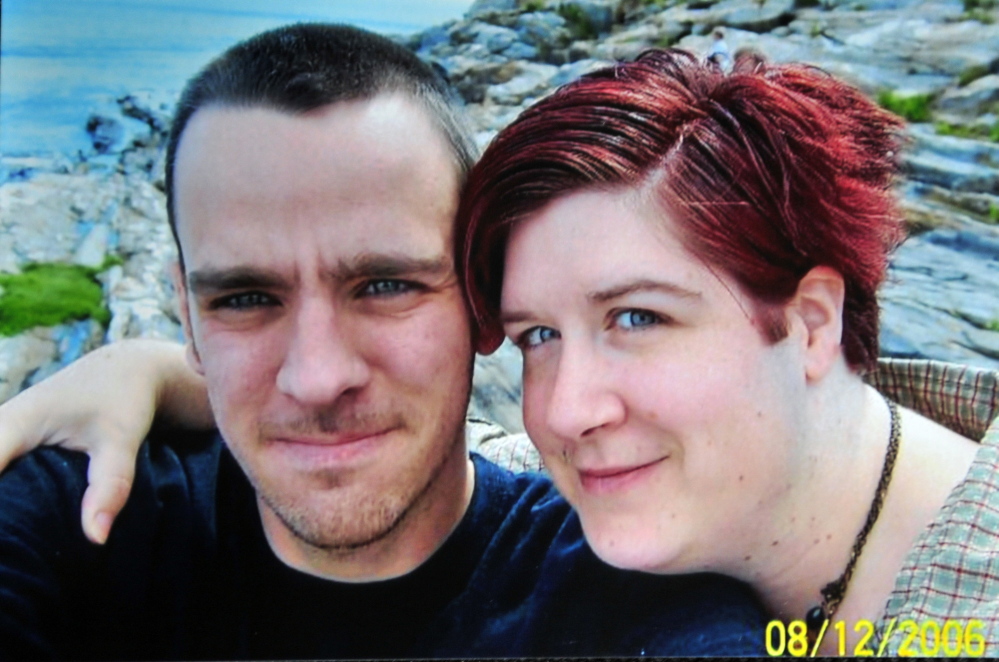

Doore proposed the bill after hearing the story of Jennifer Neumeyer of Augusta, who was denied payment of a policy she believed was held by her husband, Scott Neumeyer, who was 35 when he died of pancreatic cancer in December 2013. Neumeyer, a state employee insured by the state retirement system, believed the policy was active, but it in fact had been canceled in 2011 because of a skipped payment of $9.60. State officials say the retirement system sent a letter notifying Neumeyer at the time the policy was canceled. Jennifer Neumeyer, who only learned of the canceled policy after her husband’s death, says her family never received the letter.

Jennifer Neumeyer, who appealed the state’s decision not to pay on the policy, which totals about $100,000, recently learned the arbitrator deliberating the case has denied that appeal.

“I didn’t provide proof that I didn’t get the letter,” Neumeyer said.

She and her attorney, Daniel Dube of Lewiston, are planning a court appeal.

“I’m going to continue to fight this until they make it right,” Neumeyer said.

Doore’s original bill would have required all insurance companies in the state to send registered letters when notifying holders of cancellations, but the Legislature’s Insurance and Financial Services Committee chose to limit the impact of the bill to the retirement system and eliminate the requirement for notification by registered mail.

“I will continue to work on this,” Doore said. “I’d like to see cancellation notices be sent with some form of proof of delivery. This would protect more Mainers in these circumstances.”

Neumeyer, who has a teenage daughter, is satisfied that the law could help someone in the future.

“I am ecstatic that this is going to happen so people don’t have to go through what I have to go through,” she said.

Craig Crosby — 621-5642

Twitter: @CraigCrosby4

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.