Monmouth voters heading to the polls Nov. 8 will consider adding several vacant lots to a downtown tax increment financing district, a move that local officials hope will make the downtown more appealing to businesses.

The proposal that will be on the November ballot would add five empty lots to the district, expanding its total area by almost 100 acres and creating more opportunities for the town to shelter tax income that can be used for economic development purposes.

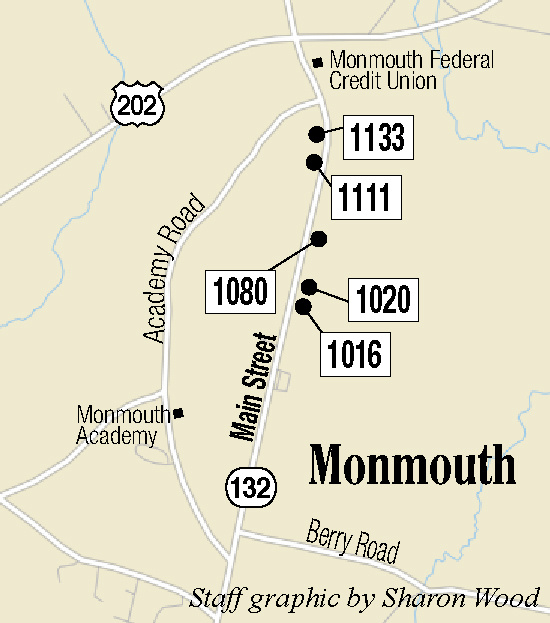

The district currently consists of a series of privately owned properties stretching along Main Street from U.S. Route 202 to Maple Street. The five properties that have been proposed for inclusion are 1016, 1020, 1080, 1111 and 1133 Main St.

“These are all vacant lots and they have potential to help the TIF zone to afford more people options to build structures to aid economic development,” Town Manager Curtis Lunt said.

One of those properties, 1111 Main St., recently came into the possession of the owners of Chalky & Co., a Monmouth-based company that makes painting kits and markets them nationwide. The company outgrew its original headquarters and is planning to build a facility at the new site. An old building had stood on that site, but the Monmouth Fire Department burned it down during a training drill in August.

The town first established the TIF district in 2013 with the goal of promoting economic development along Main Street.

At the time, Central Maine Power was building a substation and line expansion in Monmouth, a project that resulted in about $20 million in investment, according to Town Manager Curtis Lunt.

With the creation of the district and after working out an arrangement with CMP, the town was able divert half of the new tax revenue from the project into an account specially created for economic development purposes.

The town now estimates annual revenue from the TIF to be $120,000, which is split among different funds for property rehabilitation, parking facilities, marketing, streetscape work, town events, economic programs, a revolving loan fund and administrative costs.

“Gradually we’re trying to improve the infrastructure and the business climate,” Lunt said in September. “We don’t want to radically change it. We just want to make it better.”

Several benefits accrue to towns with a tax increment financing arrangement.

Collecting tax revenue in a TIF allows municipalities to use those funds for specific uses allowed under state law, including infrastructure, downtown revitalization or economic development projects. By sheltering such money in a financing district, municipalities avoid reductions in state aid to education and other negative tax effects that would occur if the new value in the district simply were added to the city’s total valuation instead of being sheltered.

Of the 19,600 acres of land in Monmouth, 318 are now in the district. The project will continue until 2033, Lunt said.

Charles Eichacker — 621-5642

Twitter: @ceichacker

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.