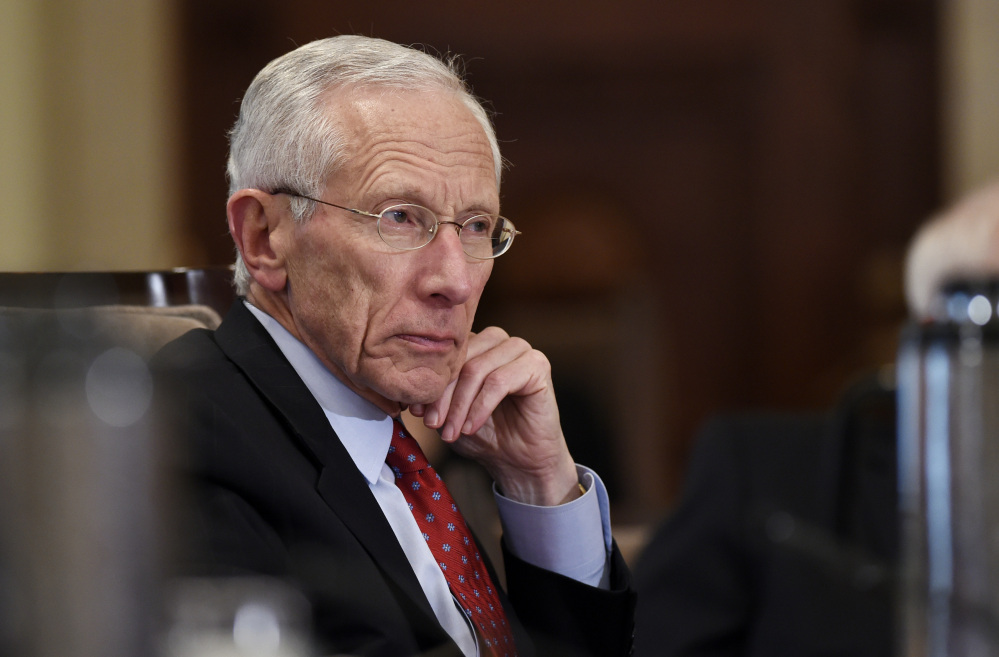

WASHINGTON — Federal Reserve Vice Chairman Stanley Fischer left the door open Saturday for a Fed rate increase in September, saying the factors that have been keeping inflation below the central bank’s target level have likely begun to fade.

Fischer said there’s “good reason to believe that inflation will move higher as the forces holding down inflation dissipate further.” He said, for example, that some effects of a stronger dollar and a plunge in oil prices – key factors in holding down inflation – have already started to diminish.

The vice chairman’s remarks came in a highly anticipated speech at an annual economic conference in Jackson Hole, Wyoming. Investors have been trying to determine whether the Fed might still be on course to raise rates after its Sept. 16-17 meeting given the recent turbulence in financial markets and fears about China’s economy, which had raised doubts. In addition, inflation has remained persistently below the Fed’s 2 percent target rate.

Fischer told the conference that Fed officials are closely monitoring developments in China and studying the latest data on the U.S. economy.

He repeated the guidelines the Fed is using to determine when to raise its key short-term rate, which has been held near zero since 2008 and has helped keep borrowing rates low throughout the economy. Fischer said the Fed wants to see further gains in the job market and to be “reasonably confident” that inflation will rise back up to the Fed’s target level. Inflation by the Fed’s preferred measure has been running below 2 percent for the past three years.

“In making our monetary policy decisions, we are interested more in where the U.S. economy is heading than in knowing whence it came,” Fischer said in his remarks, which were released in Washington. “We need to consider the overall state of the U.S. economy as well as the influence of foreign economies on the U.S. economy.”

With Fed Chair Janet Yellen having decided to skip this year’s Jackson Hole meeting, Fischer’s speech on the closing day of the conference commanded top attention at the high-profile event, with his words parsed for any signal about the Fed’s timetable for a rate hike.

Both in his speech Saturday and in an interview Friday with CNBC, Fischer made clear that the most recent economic data and the direction of financial markets over the next two weeks would help determine whether the Fed raises rates next month.

In the interview, Fischer acknowledged that before the recent market volatility, “there was a pretty strong case” for a rate hike at the Sept. 16-17 meeting, though it wasn’t conclusive. Now, the issue is hazier because the Fed needs to assess the economic impact of events in China and on Wall Street.

Fischer and Yellen have sought to reassure investors that when the Fed begins to raise rates, it plans to do so very gradually.

Other Fed officials who have spoken since the market turmoil hit with force have hinted at a delay in a rate hike. But they haven’t ruled out an increase in September.

William Dudley, president of the New York Federal Reserve, helped ignite a Wall Street rally this week when he told reporters that the case for raising rates in September was “less compelling to me” that it had been a few weeks ago, before sudden fears about China’s economy upset global markets.

But Dudley added that the notion of a rate hike “could become more compelling by the time of the meeting as we get additional information” about the economy.

Officials who want to raise rates can point to a consistently solid U.S. economy. The government estimated Thursday that the economy grew at a healthy 3.7 percent annual rate in the April-June quarter. And the unemployment rate is at a seven-year low of 5.3 percent.

But others worry that the economy remains vulnerable to shocks, such as a major slowdown in China. They also point to the still-lower-than-optimal inflation, depressed by a strengthening dollar and shrunken oil prices.

The debate isn’t confined to the Fed’s boardroom. This week, two prominent Harvard economists – Martin Feldstein and Lawrence Summers – wrote dueling opinion pieces.

Feldstein wrote in the Wall Street Journal that the market turmoil argued for the Fed to move without delay. Summers, in the Financial Times, urged delay saying a rate hike now “risks tipping some part of the financial system into crisis, with unpredictable and dangerous results.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.