If Maine voters approve Question 2, the income tax surcharge on the wealthy to fund K-12 education, many of the state’s highest earners will likely find ways to avoid paying it, several economists said.

The 3 percent surcharge, which would apply only to state tax on annual household income over $200,000, would be paid almost entirely by the top 1 percent of earners in Maine, according to the Maine Revenue Services Office of Tax Policy. If voters approve Question 2, the top marginal state income tax rate in Maine will become 10.15 percent, the second-highest in the nation after California.

But top earners tend to have some flexibility when it comes to paying taxes, the economists said. They can move money around to avoid taxes on capital gains and dividend income, or transfer their primary residence to another location. Those considering a move to Maine can choose not to come.

TAX-AVOIDANCE STRATEGIES

The Press Herald requested an analysis of the surcharge’s impact from the state Department of Administrative and Financial Services. Maine Revenue Service staff divided Maine’s 700,000 household income tax filers into percentiles to gauge the impact.

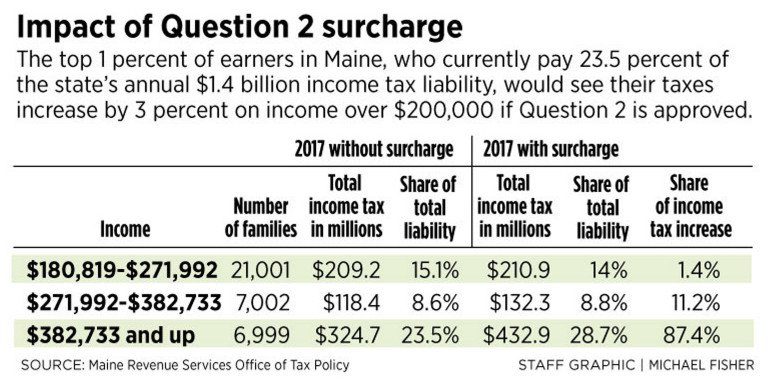

It found that households with annual income of $382,733 or higher, which places them in the 99th percentile and above, would pay more than 87 percent of the anticipated $123.8 million of income tax revenue the ballot measure would generate in 2017 if Question 2 is approved, the tax policy office said. But they’re not going to shell out those extra millions if they can avoid it, said Mike Allen, Maine’s associate commissioner for tax policy.

Tax avoidance methods may include strategies to reduce capital gains and possibly even establishing permanent residency in another state, he said.

Because the state’s highest earners are likely sophisticated investors with the means to obtain top-quality financial advice, the actual revenue generated by Question 2 may end up being considerably less than anticipated, Allen said.

“You’re talking about a group of people that have a lot of control over how much (taxable) income they earn,” he said.

That top 1 percent of earners consists of 7,000 Maine households that would bear the brunt of Question 2’s tax increase, according to the tax policy office. Those households would pay surcharges totaling about $108.2 million in 2017 if the ballot measure passes. That’s an average of nearly $15,500 per household in 2017, although the very top earners in Maine would pay far more than that.

Filers in that top bracket will contribute more than 23 percent of the $1.38 billion raised from resident income taxes in the 2017 tax year if Question 2 fails. If it passes, they would pay nearly 29 percent of a $1.51 billion tax liability.

Those between the 98th and 99th percentiles – 7,000 households earning between $271,992 and $382,733 a year – would pay a total of $13.9 million, an average of about $2,000 per household, in 2017. That group’s total share of the income tax increase would be about 11.2 percent, the tax policy office said.

Most of those in the 95th to 98th percentiles – 21,000 households earning between $180,819 and $271,992 a year – would have to pay a surcharge on their income taxes if Question 2 is approved, but it would be relatively small, the office said. The group’s total contribution would be about $1.7 million, an average of $82 per household, in 2017. Its share of the income tax increase would be about 1.4 percent.

QUESTIONABLE IMPACT

Question 2 comes more than a decade after voters decided the state should pay 55 percent of the cost of K-12 education – a goal that has never been reached. If the measure passes, the revenue is supposed to go into a specific fund that would be used to reach the 55 percent mandate if the General Fund appropriation falls short. Any money from the fund must be used for so-called “direct support,” such as instructor salaries, and may not be used for administrative purposes.

Proponents of Question 2 include the Maine Education Association, the Maine Parent Teacher Association, the Maine State Employees Association and the Maine People’s Alliance. Opponents include the Maine State Chamber of Commerce, the Portland Regional Chamber of Commerce and Educate Maine, a business-backed education nonprofit.

Proponents have said Question 2 is necessary to rectify the state’s failure to meet its voter-mandated school funding obligation. Opponents have said it is bad tax policy that would be unfair and would not have the intended effect on K-12 schools.

WIDESPREAD SUPPORT IN POLL

Philip Trostel, professor of economics and public policy at the University of Maine in Orono, said a 3 percent surcharge on income over $200,000 would hardly break the bank for Maine’s wealthiest residents. Still, Trostel said it’s likely those residents would avoid paying it as much as possible.

“The real question is what kind of tax avoidance methods we’re going to see,” he said. “There are various ways to avoid these taxes – they don’t have to leave the state.”

Trostel said it’s impossible to predict how many wealthy Mainers actually would seek to avoid the tax surcharge. A Portland Press Herald/Maine Sunday Telegram poll conducted by the University of New Hampshire Survey Center in mid-September found that Mainers earning at least $100,000 a year favored Question 2 just as much as the public at large. Sixty percent of respondents in both groups expressed their support for the measure.

Charles Lawton, chief economist for Planning Decisions Inc. who writes a weekly column for the Press Herald, said he is mostly concerned about wealthy out-of-state individuals and businesses that are considering coming to Maine. Many small business owners report income from their businesses as personal, not corporate, income. Lawton said the surcharge might be enough to keep them away at a time when economic growth is badly needed in the state.

“The effect on the people who are already here is less than the effect on the people who won’t come because of the tax,” he said.

Trostel said his primary concern about Question 2 isn’t how it would impact the wealthy, or how they would respond to the surcharge. He said investing in better schools could pay dividends from an economic development perspective that outweigh any negative consequences of a higher income tax, but only if those funds were used properly.

Trostel said history reveals that targeted tax increases such as the one proposed under Question 2 often don’t end up being used for their intended purpose. He said there is nothing in Question 2’s language that would prevent municipalities from using the extra revenue to lower property taxes or replace other education spending at the local level.

“That’s the nature of the beast – I mean these funds are fungible,” Trostel said. “Is it going to increase K-12 spending? Possibly. I don’t know.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.