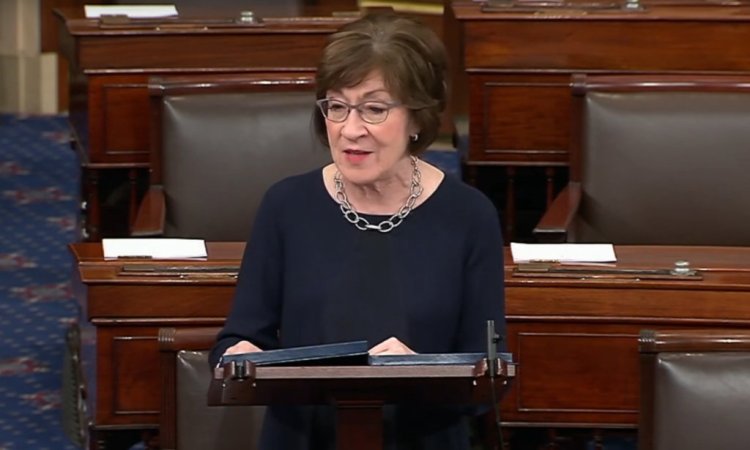

WASHINGTON, D.C. — U.S. Sen. Susan Collins of Maine is proposing legislation aimed at preventing billions of dollars in tax refunds each year from going to identity thieves instead of the taxpayers expecting the refunds.

Collins introduced her bill, the Taxpayer Identity Protection Act, in the Senate on Monday, the first day taxpayers could file returns.

Her bill proposes giving taxpayers an IRS personal identification number (PIN) to provide an extra layer of protection against fraud. The number, known as an IP PIN, is a six-digit number already being given by the IRS to taxpayers who have been the victims of tax claim fraud.

For those taxpayers, if a return is electronically filed without their IP PIN or with an incorrect number, the IRS’s system automatically rejects the tax return until it’s submitted with the correct number.

Last year the IRS issued nearly 3.5 million IP PINS to taxpayers, up from 777,000 in 2013. Within a month, the IRS had rejected nearly 7,400 fraudulent electrically filed tax claims, according to Collins. By March of last year, the system stopped nearly 1,500 returns filed by paper.

“This shows the system works,” Collins said. If taxpayers have a specific PIN that must be on the tax return, “It will stop a criminal who would not have access to that specific individualized pin number from the IRS,” because the IRS would reject the claim, Collins said.

In introducing the legislation, Collins said billions of dollars in tax returns were being siphoned annually by criminals filing fake tax returns using stolen identification information.

This story will be updated.

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.