Maine’s need to add tens of thousands of housing units over the next few years has been well documented, but a new report from the state’s housing authority illustrates how difficult it could be to simply build our way out of the housing crisis.

Dan Brennan, executive director of MaineHousing, said his agency’s 2026 outlook underscores what the agency has been saying for years: “Affordability is really the biggest issue.”

The 22-page report, released Friday, offers a few glimmers of hope — more inventory in the pipeline and declining mortgage rates could help counteract soaring home prices — but the overall outlook is grim.

The cost of construction has become prohibitively high for developers and could stall many anticipated projects. The difference between wages and housing affordability also has widened from a gap to a chasm.

Brennan, however, is optimistic.

“We’re doing good things,” he said. “Obviously, we still have challenges to face, but we know exactly what those challenges are.”

1. Homes prices, wage growth at odds

Maine’s home prices have more than doubled in the last decade, with the median price above $400,000 for the majority of 2025. Comparatively, the median home sale price in 2015 was $180,500. The Maine Association of Realtors has not yet released year-end statistics for 2025.

Median wages, meanwhile, have not increased at the same pace.

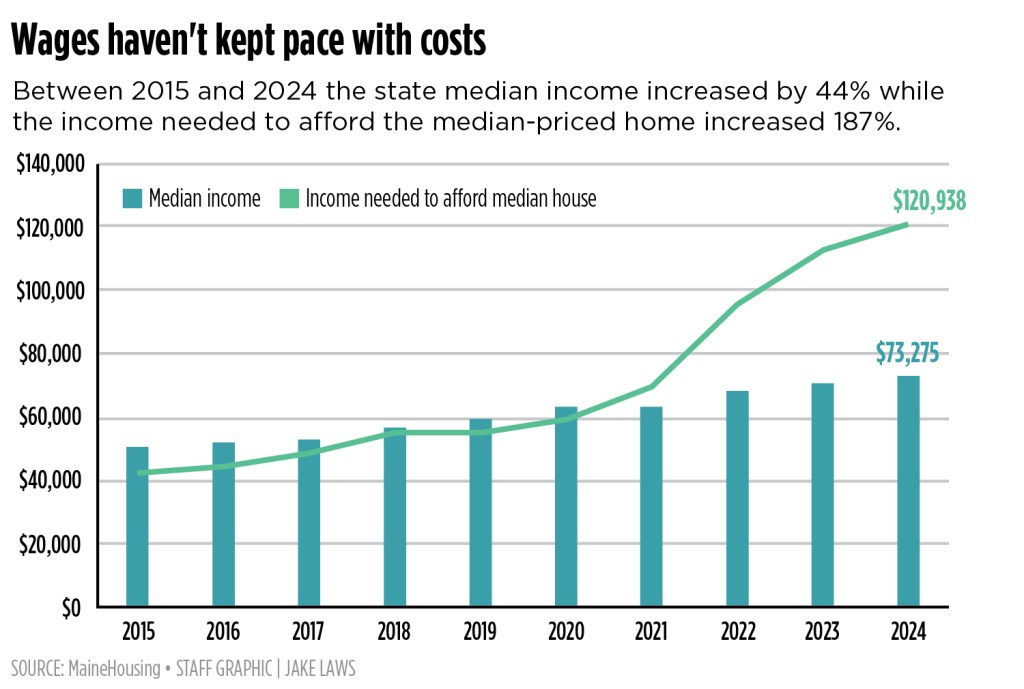

Between 2015 and 2024 (the most recent data available, according to the report), the state median income increased by around 44%, while the income needed to afford the median priced home increased 187%.

As recently as 2020, someone making the median state salary could afford the median home price, but in each year since, the gap between the two has widened.

In 2024, the median income in Maine was $73,275. The income needed to afford the median home was $120,938.

Historically, the state’s median home sale price has grown more slowly than the nationwide price.

But that trend has reversed since the pandemic. Between 2021 and 2025, Maine’s median home sale price increased by almost 37%, while the U.S. median increased by just 19%, according to the report.

“In the face of these trends, it is unsurprising to hear Maine households reporting that the dream of homeownership feels out of reach for them,” the report says.

Real estate experts have predicted a more level market in 2026, thanks in part to an increase in housing production as well as a drop in mortgage rates.

The average rate on a 30-year mortgage in Maine peaked at 7.8% in late 2023 and mostly hovered around 7% throughout 2024 and 2025. Recently, numbers have dropped closer to 6%, which gives prospective home owners more buying power.

2. Developers are ready to build more

The lack of inventory is one of the main drivers of high home sale prices, but there’s plenty of interest in building more.

MaineHousing added 755 low- and middle-income units to the state’s affordable housing stock last year, and there are more than 1,200 lined up — a record for the agency. Of those, more than 800 are expected to be move-in ready by the end of the year.

Last year was also a banner year for approvals elsewhere in the state. In Portland, for example, city officials gave the green light to a record 1,321 units, of which 380 were income-restricted, according to the city’s housing dashboard.

More comprehensive statewide housing data is expected later this year.

MaineHousing officials are optimistic that the agency can keep up the breakneck construction pace of the last few years — as long as it gets the funding it needs.

A few crucial pools of money, including funding for most of the agency’s multifamily units, have run dry, but Brennan said he’s hopeful Gov. Janet Mills will include money for housing in her supplemental budget and lawmakers will consider a housing bond.

Without those, Brennan said the housing authority’s production could drop to just 200 units per year.

3. They may have to wait awhile

High costs have kept some projects from moving forward, stalling the forward momentum from the bump in approvals.

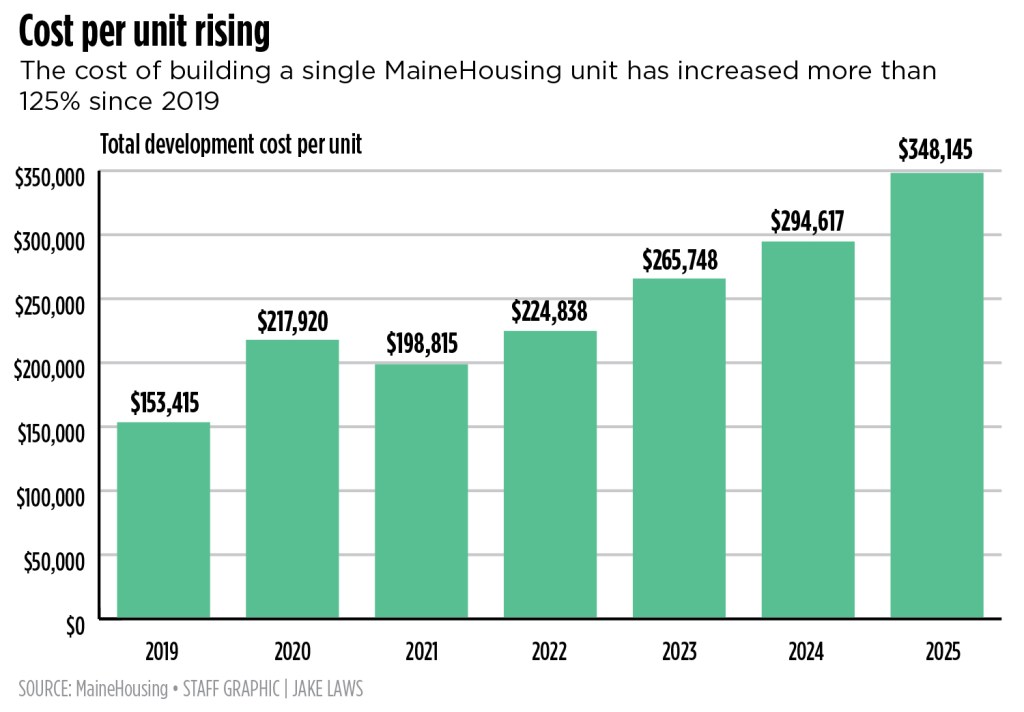

In 2019, it cost about $153,415 for a developer to build one unit for MaineHousing. By last year, that number had more than doubled to $348,145 according to the report.

That number could go down slightly in 2026, Brennan noted, because there are some large-scale, expensive projects under construction that won’t be included in next year’s calculation.

“But that doesn’t change the narrative that it’s very expensive to develop these projects,” he said.

In Portland, where there are additional costs from inclusionary zoning requirements, some large-scale developments have been put on hold.

Supply chain issues, general inflation, a tight labor market, rising wages and an unpredictable federal policy environment have all pushed up costs.

Further complicating matters is the federal Build America Buy America program, which requires federally funded projects to use domestically sourced construction materials.

According to Brennan, that’s causing some projects to “stop in their tracks.”

MaineHousing and the state’s congressional delegation have requested either an exemption for affordable housing projects, or at least a delay while manufacturing companies try to catch up.

“We’re not against buying American-made, but we’re at the mercy of the industrial side being ready,” Brennan said.

We invite you to add your comments. We encourage a thoughtful exchange of ideas and information on this website. By joining the conversation, you are agreeing to our commenting policy and terms of use. More information is found on our FAQs. You can modify your screen name here.

Comments are managed by our staff during regular business hours Monday through Friday as well as limited hours on Saturday and Sunday. Comments held for moderation outside of those hours may take longer to approve.

Join the Conversation

Please sign into your CentralMaine.com account to participate in conversations below. If you do not have an account, you can register or subscribe. Questions? Please see our FAQs.