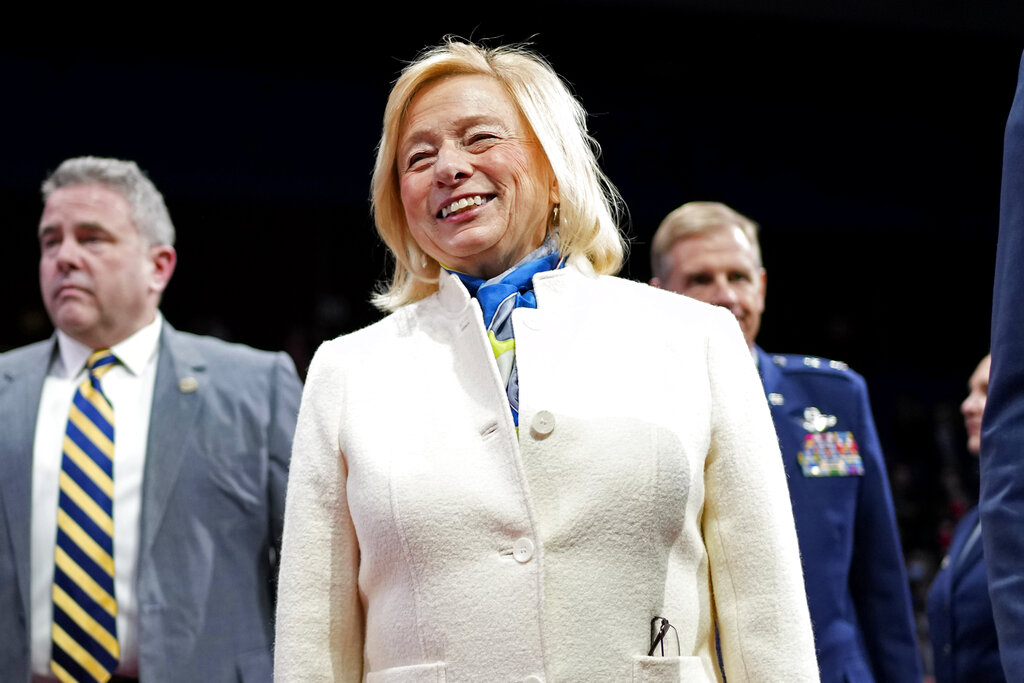

Gov. Janet Mills unveiled a supplemental budget Wednesday that serves as the Democrat’s final spending plan of her eight-year tenure, and seeks to push back on federal policy changes from the Trump administration.

In a written statement, Mills, who is running for the U.S. Senate, highlighted her “three-part affordability agenda,” focusing on a topic that Democrats hope will resonate with voters ahead of the 2026 midterm elections.

“Through this proposal, we are delivering financial relief to Maine people, addressing high housing costs, and making free community college — a highly successful program for Maine students — permanent,” Mills said. “At the same time, we are maintaining core commitments, like funding for education and for health care, that help lower costs for folks across our state.”

Republicans, meanwhile, continued to point out that, despite a series of surpluses, the state budget has grown by about 60% under Mills. Last year, the Legislature approved a slate of governor-proposed tax and fee increases, including increasing taxes on cigarettes and adding a tax to streaming services.

Mills had already used her State of the State speech and recent news releases to share a few of her spending ideas, such as $300 “affordability checks” for about 725,000 Mainers who fall under certain income levels; $2.25 million for reproductive health care providers affected by federal cuts and $70 million for new housing.

The full spending blueprint that her office released Wednesday offers more proposals that seek to make use of the state’s nearly $250 million surplus.

It includes a proposal to increase minimum salaries for school teachers from $40,000 to $50,000 by 2029. Those increases would be phased in, beginning with a $5,000 bump in the fall of 2027.

It proposes $46 million so the state can continue to meet a voter-approved mandate to fund 55% of public education costs. If approved, the state’s share of education payments would increase to nearly $1.6 billion next fiscal year — up from nearly $1.1 billion in fiscal 2019.

Mills is proposing a one-time infusion of $25.4 million from the state’s so-called rainy day fund for the Maine Commission on Public Defense Services, which faces backlogs and funding shortfalls in representing people who cannot afford an attorney.

Her budget includes $6.7 million in funding for artificial intelligence initiatives, which would go to harnessing the technology and establishing safeguards — acting on the recommendations of the governor’s task force on the subject.

And another $62 million is included in the proposed budget for increased costs to the state’s Medicaid program, known as MaineCare.

Some proposed investments respond to federal cuts, including $14.7 million in cost shifts in Medicaid and food assistance, plus $4.9 million in one-time funding for technology upgrades to implement mandates included in the “One Big Beautiful Bill Act” signed by President Donald Trump last year.

One proposal not highlighted by the administration would give the governor more power to tap the state’s rainy day fund in a declared emergency.

The budget would allow the governor to distribute up to $1.5 million in emergency heating assistance to Maine State Housing Authority and $4 million to local groups providing food assistance to people in need if a declared emergency lasts more than 10 days. Currently, she can distribute just $400,000 for that latter purpose.

The budget also proposes a five-year extension to an economic development program at the former Loring Air Force base in Limestone.

The Loring Job Increment Financing Fund was set to expire on July 1, but Mills has proposed extending it to 2031. Her proposal increases the amount of funding for the program from 50% of the income taxes collected by new jobs in the base area to 100%.

The Legislature must adopt Mills’ spending proposals if they are to become reality. Democrats have controlled the Legislature for all eight years of Mills’ tenure, but their majority in the Maine House of Representatives is down to a narrow 75-73 advantage.

Republican lawmakers say they oppose the governor’s $300 checks, which would come from $218.5 million in the state’s rainy day fund. Republican members are instead calling for conformity with Trump’s tax breaks, a higher standard tax deduction and a $6,000 tax break for Mainers who are 65 and older.

Democratic lawmakers will have leverage to pass the governor’s plan as proposed, though the governor and her party’s legislators have clashed over previous budget proposals.

We invite you to add your comments. We encourage a thoughtful exchange of ideas and information on this website. By joining the conversation, you are agreeing to our commenting policy and terms of use. More information is found on our FAQs. You can modify your screen name here.

Comments are managed by our staff during regular business hours Monday through Friday as well as limited hours on Saturday and Sunday. Comments held for moderation outside of those hours may take longer to approve.

Join the Conversation

Please sign into your CentralMaine.com account to participate in conversations below. If you do not have an account, you can register or subscribe. Questions? Please see our FAQs.