AUGUSTA — Scott Neumeyer spent the last 13 years of his life bouncing from one severe illness to another, but still, the end came suddenly and surprisingly, just a few weeks after learning he had pancreatic cancer.

As Neumeyer’s body rapidly gave way to the creeping cancer, he worried that he would not be there to help his wife, Jennifer, raise their daughter, 13-year-old Colleen. He took comfort, however, in knowing that at least the life insurance policy he had through his state job would provide a small financial cushion for Jennifer Neumeyer as she scrambled to get her feet back under her in her new role as a widow and single parent. What neither Scott nor Jennifer Neumeyer knew, however, was the policy had been canceled more than three years earlier. Jennifer Neumeyer is still scrambling, but there’s no financial cushion and the future seems even more uncertain and frightening than she ever imagined it could.

“I’m extremely lost,” Jennifer Neumeyer said. “I don’t know what to do.”

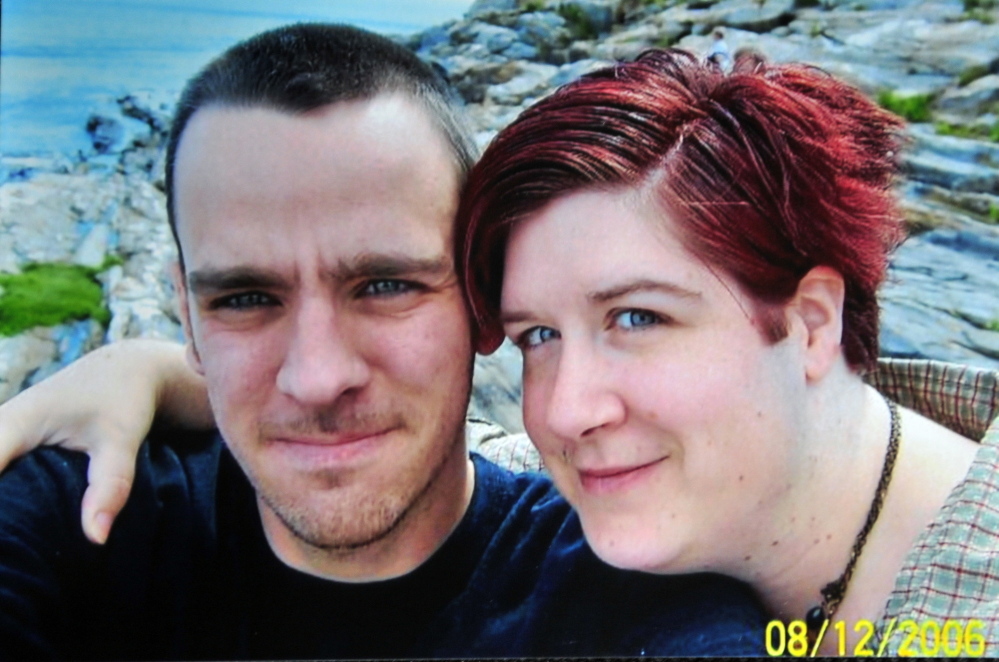

Scott Neumeyer, who was 35 when he died in December, met Jennifer, now 43, in 1998 while each was visiting an online chat room. Scott, a native of Edmonton, Alberta, Canada, was living in Washington. Jennifer was studying in New Hampshire. There were a lot of reasons she fell for Scott Neumeyer. His 6-foot 9-inch height and sense of humor were part of it.

“I’ve always liked tall guys,” Jennifer Neumeyer said, grinning. “Scott always joked he was 5 foot 21 inches. It was all in the shoes.”

They married in 2000. Colleen arrived the next year. A 7th grader at Cony, Colleen shares her dad’s height, his dry sense of humor and his tender devotion to Jennifer.

“I want her life to be as normal as possible,” Jennifer Neumeyer said.

Shortly after Colleen’s birth, in early 2001, Scott Neumeyer was hospitalized several times for an unidentified sickness. Doctors finally determined he had an aggressive form of ulcerative colitis.

“That was the last time his body ever functioned properly,” Jennifer Neumeyer said. “It was the perfect storm of diseases.”

Scott Neumeyer, who was subsequently diagnosed with diabetes that required him to take insulin the rest of his life, went from 220 pounds to 180 pounds and became very weak, Jennifer Neumeyer said.

“That’s how Scott lived his life for 13 years,” she said. “Then came the blood clots and hours spent at the hospital with medication that didn’t always treat his body well.”

Scott Neumeyer went to work for the state in 2003. He was an office assistant for the Department of Labor when he died. Jennifer Neumeyer, who also works for the state as a secretary for Parks & Lands, said her husband was an ardent union supporter and was eager to entice younger government employees to get more involved in union activity. Through his union work and helping people find work, Scott Neumeyer felt like his job made a difference to people even if it was less than intellectually stimulating work.

“He used to say, âA well paid monkey could do my job,'” Colleen Neumeyer said, laughing at the memory. “He felt like he was helping people.”

What is undisputed by the state or Jennifer Neumeyer is that Scott Neumeyer signed up for life insurance when he took the job with the state.

“He was smart enough to sign up for life insurance when he had the chance,” Jennifer Neumeyer said.

That policy, equal to three times his salary, about $120,000, became active on Jan. 1, 2004. The premiums were taken automatically from Scott Neumeyer’s paycheck.

That process was interrupted, however, in June 2011 when Scott Neumeyer broke his femur when he slipped and fell while running across a wet parking lot. Neumeyer was out of work for an extended period and wound up missing at least one paycheck, Jennifer Neumeyer said. The missed work interrupted health insurance payments, which also were taken directly out of Scott Neumeyer’s paycheck.

“In that time frame, health insurance contacted us by letter and then by phone saying his premiums weren’t paid and sent us a bill for about $1,300, which I paid,” Jennifer Neumeyer said.

Unbeknown to her or Scott Neumeyer, the missed paycheck had also impacted his life insurance policy.

John Milazzo, general council and chief deputy director for the Maine Public Employees Retirement System, declined to answer specific questions about Scott Neumeyer’s policy pending Jennifer Neumeyer’s appeal, but Milazzo did provide a copy of the rejection letter he sent to Jennifer Neumeyer after reviewing the claim. In it Milazzo said the policy was still active in July 2011 when the Maine Public Employees Retirement System received notice that Scott Neumeyer was out on unpaid health leave that began in mid June. The retirement system sent a bill to the Neumeyer’s home on Aug. 1, 2011, requesting a payment of $9.60.

“The notification stated that the premiums were due by Aug. 15, 2011,” Milazzo wrote.

Jennifer Neumeyer said they never received that letter. The retirement system, which confirmed it had the correct address, said there is no indication the letter was returned as undeliverable.

“I got a letter for health insurance for $1,300 and I paid it,” Jennifer Neumeyer said. “Why wouldn’t I pay one for $9.60? It doesn’t make sense.”

The retirement system mailed on Aug. 15, 2011, that the policy would be canceled if premiums were not paid within two weeks.

“No premiums were received within that state time frame,” Milazzo wrote. “It is axiomatic that an insured’s life insurance coverage terminates upon non payment of premiums.”

Jennifer Neumeyer said the second letter, like the first, was never delivered to their home. Then, in February, she learned that some contributions were taken from Scott Neumeyer’s checks in error. The retirement system said they would send a refund check the next month.

“To date I haven’t received that check,” Jennifer Neumeyer said. “They said it was probably lost in the mail, to which I said to them, âAlong with my invoice from 2011.’ Sometimes I get letters from them and sometimes I don’t.”

Jennifer Neumeyer said they never noticed life insurance premiums were no longer being taken from Scott Neumeyer’s paychecks. His life was a whirlwind of hospital visits, hospitalizations and medications. He frequently missed time from work, sometimes just a few hours, sometimes days.

“Scott rarely had a check that didn’t have some time off payroll,” Jennifer Neumeyer said. “The amount of his paychecks was random from payday to payday. I had no reason to look at it. He was a state employee. He automatically has life insurance.”

Jennifer Neumeyer learned the life insurance policy had elapsed when she talked to human resources the day she went to clean out her husband’s desk after his death.

“They told me he didn’t have life insurance,” she said. “I said he did have life insurance, and he’d been paying it for 10 years.”

Jennifer Neumeyer said they never got a phone call that the policy had been canceled, and nobody in human resources mentioned reinstating the policy when Scott Neumeyer returned to work.

“Nobody did that,” she said. “When he came back after his injury, he should have been reinstated.”

Jennifer Neumeyer said the missed premium payments since August 2011 total about $600, a bill she would still gladly pay to reinstate Scott Neumeyer’s life insurance. She has appealed the state’s decision and continues to hope for a favorable resolution.

“It’s just frustrating,” she said. “People shouldn’t have to go through this. I lost my husband. She lost her father. I’m not looking for millions. I am just looking to receive what is due to me and my daughter. What both my husband and I believed we were paying into each month.”

Jennifer and Colleen Neumeyer are trying to decide where to continue rebuilding their lives. Jennifer and Scott Neumeyer had talked about trying to buy the home they’re renting and making a permanent life there, but now Jennifer Neumeyer doubts they’ll be able to stay at all. She can’t afford the rent on her own. Scott Neumeyer’s life insurance money would have given her more options.

“The people I’m renting from are extremely nice people,” she said. “I’m basically living on their generosity. That can only last for so long.”

Colleen Neumeyer wants to seek a life of adventure with her mom. She dreams of moving to Germany, where Jennifer Neumeyer lived years ago, or even to Canada to be near Scott Neumeyer’s family in Alberta. Colleen Neumeyer has been to camp at the Maine School of Science and Mathematics in Limestone. She’d love to go to school there full time when she is a freshman in a little over a year. Jennifer Neumeyer wonders how she will afford to make that happen.

Jennifer Neumeyer is focused on trying to stay in Augusta where the memories of her husband linger. She surveys the room, still alive with her husband’s books, clothes and trinkets. Her eyes begin to flood again.

“We used to talk about what we’d do with the house,” she said. “Now those plans are gone.”

Craig Crosby — 621-5642 | ccrosby@centralmaine.com | Twitter: @CraigCrosby4

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.