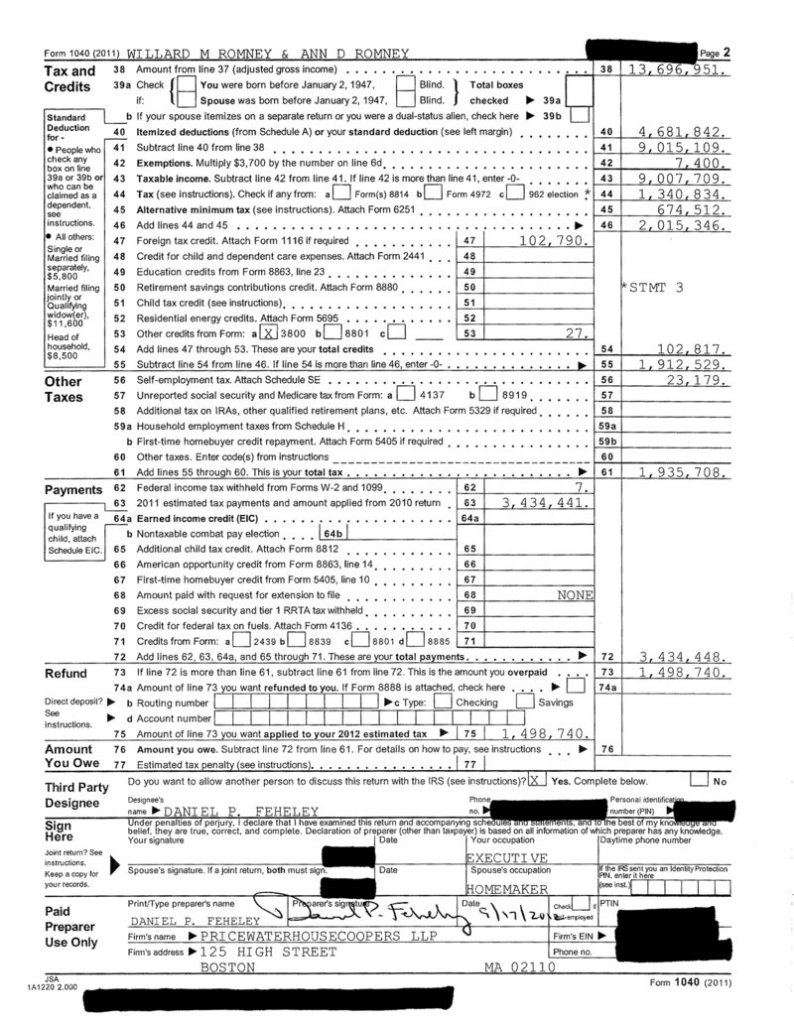

Mitt Romney paid $1.9 million in taxes on $13.69 million in income in 2011, most of it from his investments, for an effective rate of 14.1 percent, according to hundreds of pages he released Friday in a move to quiet political controversy over his personal finances.

The Republican presidential nominee could have paid less in taxes, but he engineered his 2011 returns to overpay the government to ensure that his effective tax rate would “conform” with his statement last month that he had paid at least 13 percent, according to his trustee, R. Bradford Malt.

Romney did that by not taking full advantage of his charitable deductions. In their joint return, he and his wife, Ann, listed $4.02 million in donations to charity last year — nearly 30 percent of their income — which substantially reduced their tax obligation. They claimed a deduction for only $2.25 million of those contributions.

Had the Romneys deducted all of their charitable donations, they would have paid about $467,000 less in taxes for an effective rate of 10.55 percent, according to an analysis by Rebecca Wilkins, a tax lawyer with the Citizens for Tax Justice.

Romney can amend his returns at any point over the next three years to take advantage of the potential deductions. If the Romneys had not taken any charitable deductions, their rate would have been 18.8 percent, said Wilkins.

Friday’s disclosures followed months of political pressure on Romney, one of the richest Americans ever to win a major party’s nomination, to reveal more information about his personal fortune, which is estimated at $190 million to $250 million.

This comes at the end of a turbulent week for Romney’s campaign during which a leaked video showed the candidate, at a private fundraiser in May, dismissing the 47 percent of Americans who pay no income taxes. He said they were like “victims” and feel entitled to government handouts. “I’ll never convince them they should take personal responsibility and care for their lives,” he said.

Although Romney made good on his promise to release two years’ worth of tax returns — he released his 2010 filings in January — the disclosures are unlikely to silence his critics, including President Obama and his allies.

Romney’s 379-page 2011 returns show that he earned $6.8 million from capital gains and $3.6 million in interest. Romney earned about $190,000 in author and speaking fees, as well as $260,390 for sitting on the board of Marriott International.

None of his income was from wages. Capital gains are taxed at a flat rate of 15 percent, substantially lower than the 35 percent rate typically levied on the wages of those with the highest incomes.

In 2010, Romney earned $21.7 million and paid $3 million in taxes, for an effective rate of 13.9 percent.

Romney’s 2011 returns are substantially different from the estimate his campaign provided in January. The estimate reported that he earned $20.9 million in 2011 and would pay $3.2 million in taxes, for an effective rate of 15.4 percent. Campaign spokeswoman Michele Davis said the difference was because the couple’s income varies “significantly from year to year, depending primarily on what investments are sold and how much they have appreciated or depreciated.”

Davis added that the couple filed for an extension, as they had in prior years, because not all of their investment information was available by the April 15 deadline. She said, however, that all taxes owed for 2011 were paid by April 15 and that the couple filed their returns Friday.

Romney also released a summary of his effective tax rates between 1990 and 2009, reporting that his average annual rate was 20.2 percent and that he never paid less than 13.66 percent. But the summary does not detail the size of Romney’s income and the amount of taxes during those years. The letter, produced by preparer PricewaterhouseCoopers, provides no information about how his investments fared during 2008 and 2009, a time of great upheaval in global markets and steep losses for most investors.

Obama and other Democrats have used Romney’s reluctance to release more financial information as evidence that the candidate has been excessively secretive about the fortune he amassed as founder and chief executive of Bain Capital, a private equity firm.

Stephanie Cutter, Obama’s deputy campaign manager, said Friday’s disclosure of the tax returns “continues to mask Romney’s true wealth and income from Bain Capital, leaving the American people in the dark about critical details about his finances.”

In television advertisements and stump speeches, Obama, Vice President Joe Biden and other Democrats have suggested that Romney is hiding something about his personal finances. They noted that Romney’s father, George, released 12 years’ worth of tax returns when he ran for the Republican presidential nomination in 1968.

In August, Senate Majority Leader Harry Reid, D-Nev., said that he was told by an investor at Bain Capital, the private equity firm Romney co-founded and ran, that Romney had paid no taxes for at least 10 years because of his success at taking advantage of tax breaks.

Romney dismissed Reid’s charge as “totally false.”

The pressure to release more tax filings has long rankled Romney. In August, he told reporters, “The fascination with taxes I’ve paid I find to be very small-minded compared to the broad issues that we face.”

There is no legal requirement for presidential candidates to release any income tax returns, although the Federal Election Commission requires them to file personal financial disclosures.

Romney’s campaign has long highlighted his charitable contributions, sometimes grouping them with his taxes to show that he has given away a significant portion of his income even if his tax rate is not that high. The campaign said that between 1990 and 2009, his federal and state taxes and charitable donations together represented 38.49 percent of his total adjusted gross income.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.