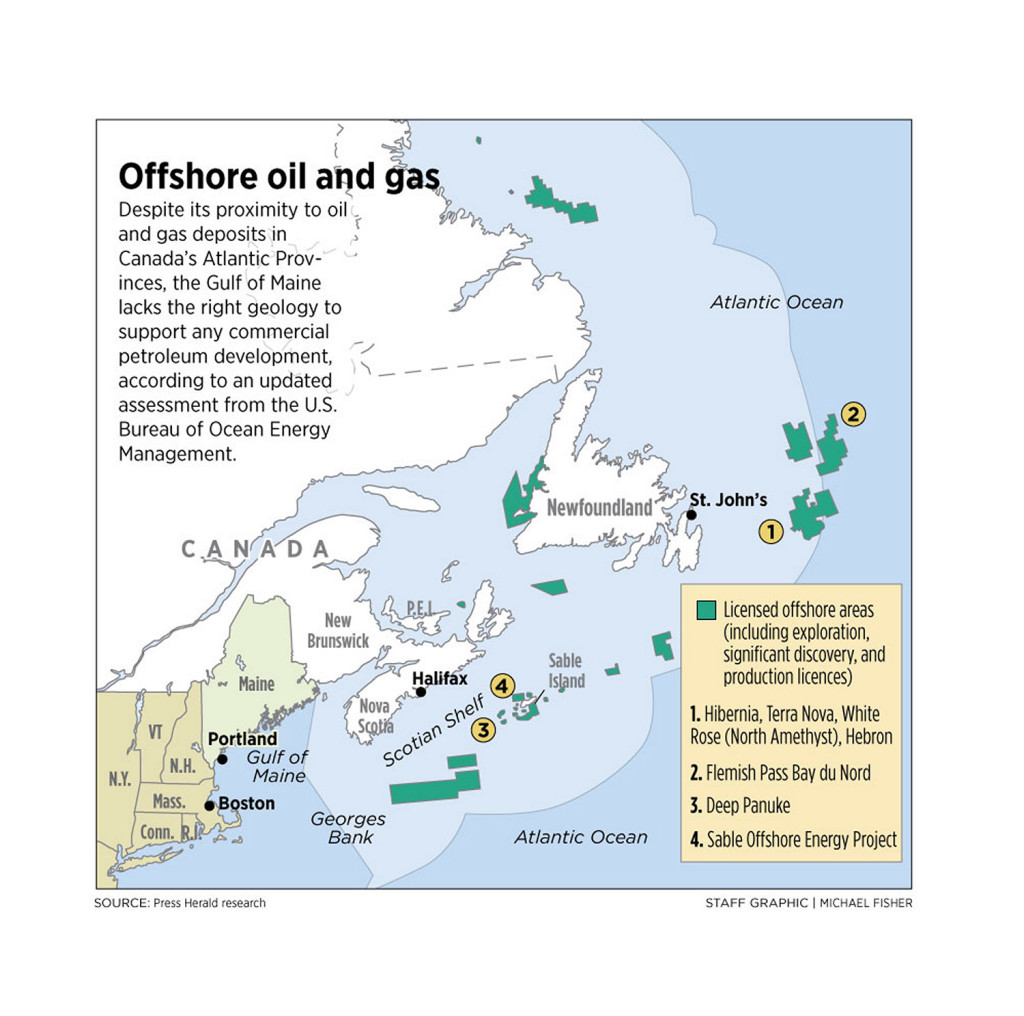

A coalition of U.S. governors pushing for more offshore oil and gas drilling turned heads in Maine last month when it announced that Gov. Paul LePage had become a member. But LePage’s participation doesn’t foreshadow oil rigs off the Maine coast – the latest federal research suggests that the Gulf of Maine lacks the right geology to hold commercial deposits of oil or natural gas.

The assessment by the Bureau of Ocean Energy Management, updated last year, trimmed the already modest estimates in the North Atlantic to levels that virtually eliminate the possibility of oil and gas drilling off New England.

“In plain English, the geology doesn’t support commercial viability,” John Filostrat, a spokesman for the bureau, told the Portland Press Herald. “Based on the assessment of the data we have, there’s no resource potential in the Gulf of Maine.”

At the same time, the report greatly increased estimates for the amount of oil and gas that may be hidden under the seabed in the South Atlantic.

JOINING COALITION CREATES WAVES

The bureau’s Resource Evaluation Division identifies areas on the Outer Continental Shelf that seem most promising for oil and gas development. The work isn’t widely followed in Maine, but it’s noteworthy here now, in part because of LePage’s involvement in the coalition.

LePage is the first Northeast member of the Outer Continental Shelf Governors Coalition, which receives support from a Houston-based alliance that represents hundreds of corporate interests, including many oil and gas companies.

LePage’s office said the governor joined because he supports natural gas development as a way to help lower energy costs for Mainers. But his action was criticized by environmental groups that want to reduce New England’s growing dependence on gas, including the Maine Chapter of the Sierra Club.

Glen Brand, the chapter’s director, said offshore oil drilling poses an unacceptable risk. He said LePage’s membership is motivated by ideology and won’t have any practical impact.

“I assume this is symbolic, a way of throwing red meat to a right-wing audience,” Brand said.

BETTER PROSPECTS IN OTHER AREAS

LePage’s action followed a proposal last month by the Obama administration to sell leases beginning in 2017 to energy companies that want to develop oil and gas projects in sites off the coasts of Virginia, North Carolina, South Carolina and Georgia. Actual drilling, if it happens, could be years away. But public hearings are ramping up from Georgia to New Jersey, pitting the benefits of economic growth and energy independence against the risk of oil spills that could foul beaches and ruin fisheries.

These developments come as energy companies in Canada are assessing what may be the largest oil discovery off the coast of Newfoundland and Labrador in 30 years, called Bay du Nord.

The Gulf of Maine has seen very limited oil and gas exploration. Ten test wells were drilled during the 1970s on the historically rich fishing grounds of the Georges Bank. Leasing bans in both the United States and Canada have since put Georges Bank off limits.

Those bans are political decisions that can be changed. But the latest methods of reading the seismic data taken during the 1970s could make any future debate moot. They show that, for better or worse, the Gulf of Maine’s geology doesn’t support commercial oil and gas deposits, despite its location between regions that do.

BIG CHANGES TO RESOURCE ESTIMATES

In its 2014 update on the Atlantic Outer Continental Shelf, the ocean energy bureau reviewed 10 seabed geological deposits within 200 miles of the coast. The assessment incorporated a technique by which new oil discoveries elsewhere in the world were taken into account because they have similar geologic and geochemical characteristics to those in the Atlantic.

Using all this data, the bureau estimated that undiscovered oil and gas resources in the Atlantic totaled 4.72 billion barrels of oil, up 43 percent from the estimate three years earlier. Natural gas potential was 37.51 trillion cubic feet, up 20 percent.

These are still small numbers. For comparison, the oil and gas potential of the entire Atlantic coast is a small fraction of what lies under the Gulf of Mexico, according to bureau figures.

In the North Atlantic, the potential was scaled back slightly, from 2 billion barrels of oil to 1.75 billion and from 18 trillion cubic feet of natural gas to roughly 12 billion, in the area that runs from the Delaware border through the Gulf of Maine to the Canadian border.

This assessment doesn’t surprise Robert Marvinney, Maine’s state geologist. He reached a similar conclusion in 2009, when he used an earlier version of the bureau’s data to prepare an assessment of oil and gas development potential in the Gulf of Maine for the state’s Ocean Energy Task Force.

Marvinney said it’s possible that future exploration and production technologies could bring unexpected changes, the way hydraulic fracturing has opened up major gas fields in shale deposits under Pennsylvania.

“But in our region, the real opportunities, the geological conditions, just aren’t here,” he said. “The best places to go (for exploration) are places with known production.”

OFF CANADA, AN ARRAY OF PROJECTS

In the North Atlantic, that means Canada, specifically Newfoundland and Labrador. The province already produces 40 percent of Canada’s light crude oil, from the Hibernia, Terra Nova and White Rose fields. A new field, called Hebron, is due to begin pumping in 2017.

But the biggest potential lies with the Bay du Nord discoveries announced in 2013, in a deep-water area called the Flemish Pass Basin. It’s being developed by a partnership that includes Statoil, the Norwegian energy company. A Statoil subsidiary left Maine in 2013 after an attempt to build a pilot wind energy project off the coast was thwarted by LePage.

Closer to Maine, the Deep Panuke natural gas project off Nova Scotia began pumping in 2013, although it has suffered production problems. Deep Panuke is near the Sable Island gas fields that were developed in 1999, and feed the Maritimes & Northeast Pipeline across Maine to Massachusetts. But Sable highlights the unpredictable nature of petroleum exploration. Production is slowing and the project’s lead owner, Exxon-Mobil, has announced plans to phase out the project short of its expected 25-year lifespan.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.