AUGUSTA — Democratic lawmakers unveiled proposals Thursday to cut income taxes for Mainers earning less than $150,000 and expand a popular property tax exemption, while paying for the cuts by holding the line on taxes for the wealthy and for corporations.

The Democrats released their tax reform counter-proposal exactly three months after Republican Gov. Paul LePage proposed the most sweeping tax overhaul in years. Democratic leaders actually adopted many of LePage’s proposals – including broadening the sales tax and eliminating income taxes on military pensions – but claim their income and property tax plans are geared more toward Maine’s middle class.

The Democratic leadership also asserts that, unlike the governor’s plan, their tax relief proposals will not create a budget shortfall in future years.

“The Better Deal for Maine builds on Governor Paul LePage’s tax reform plan, but targets it more towards middle income families,” reads the plan. “It rejects the failed top-down economic policies that give tax breaks to the wealthy and corporations at the expense of the rest of us.”

The Democrats’ proposal – which will become part of the State House budget debate – would:

• Lower income tax rates for Mainers earning between $20,900 and $150,000 a year but not as much as LePage’s proposal. Those earning more than $150,000 would not see a tax cut under the Democratic plan.

• Double the Homestead Exemption property tax benefit from $10,000 to $20,000 for all homeowners; LePage proposed doubling it for those 65 and older but eliminating it for others.

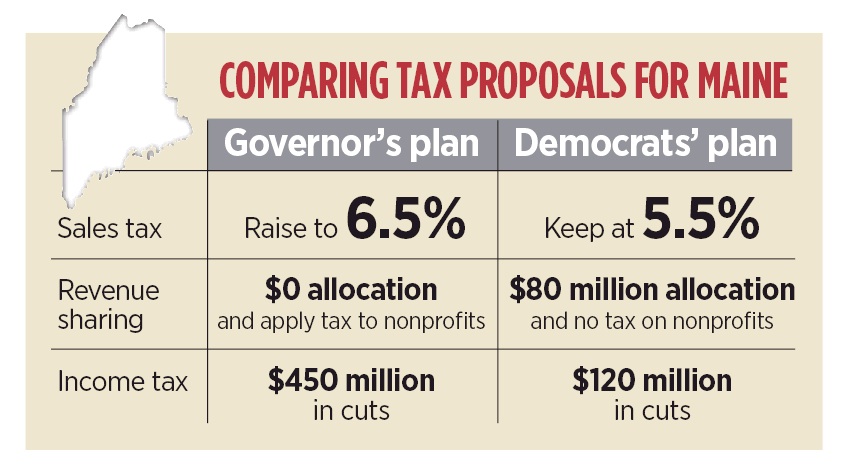

• Maintain the general sales tax rate at 5.5 percent; LePage proposed going to 6.5 percent.

• Adopt LePage’s plan to apply the sales tax to hundreds more goods and services.

• Reject LePage’s proposal to eliminate revenue sharing and to collect property taxes from larger nonprofits.

• Reject LePage’s plan to reduce corporate income tax rates and close a “loophole” on offshore tax havens.

• Maintain the current estate tax; LePage proposed increasing the exemption and then eliminating the tax altogether.

Overall, the Democratic plan would provide $120 million in income tax relief to Mainers, compared to nearly $490 million per year in LePage’s plan. The Democrats insist that almost all of their cuts will go to the bottom 95 percent of the state’s earners.

The Democrats’ plan provides a long-awaited and some would say long-overdue political counterpoint to the tax proposals contained in LePage’s $6.57 billion budget, which has dominated discussion in Augusta since its release in early January.

Democrats have repeatedly accused LePage of catering his tax breaks to the wealthy, pointing out the governor’s plan would provide more than $10,000 in relief to those earning $400,000 a year compared to $145 for Mainers earning $40,000. But until Thursday, Democrats had failed to offer a specific alternative.

“While Democratic leaders commend the Governor for initiating a much-needed conversation about tax reform, his budget takes Maine in the wrong direction,” reads the plan. “Maine’s economy lags behind the nation in job growth and wages. His budget will make it worse.”

The dueling tax reform plans, with their clear differences over taxing the wealthy and corporations, will likely influence negotiations to craft a new two-year budget before the Legislature’s scheduled adjournment date in June.

It is clear that LePage will not get everything he wanted in his budget. It appears the Legislature will, however, send him a budget that cuts income taxes for most Mainers. The questions are by how much and how those tax breaks should be distributed across Maine’s income spectrum.

LePage is likely to push back against any attempt to reduce the tax relief he proposed for wealthier Mainers and businesses.

The governor proposed cutting the top income tax rate from 7.95 percent to 5.75 percent by 2019, immediately eliminating all income taxes on military pensions and phasing out the estate tax. The governor argues that those proposals, along with his plans to reduce the corporate income tax, are critical to attracting businesses and ensuring more wealthy retirees reside in Maine.

To offset those revenue losses, LePage suggested increasing the sales tax rate to 6.5 percent from 5.5 percent and eliminating sales tax exemptions on hundreds of goods and services.

“During my first term, we took the first step toward significant tax relief,” LePage said during his Jan. 9 budget unveiling. “In this budget proposal we are modernizing Maine’s out-of-date tax code to make Maine more competitive with other states.”

Both the governor and Democrats said their respective plans would capture more tax revenues from tourists.

Kevin Miller can be contacted at 791-6312 or at:

Twitter: KevinMillerPPH

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.