General Electric says it may move up to 500 jobs, including some now in Maine, to Europe because Congress failed to reauthorize the Export-Import Bank, which underwrites many foreign sales of American-made products.

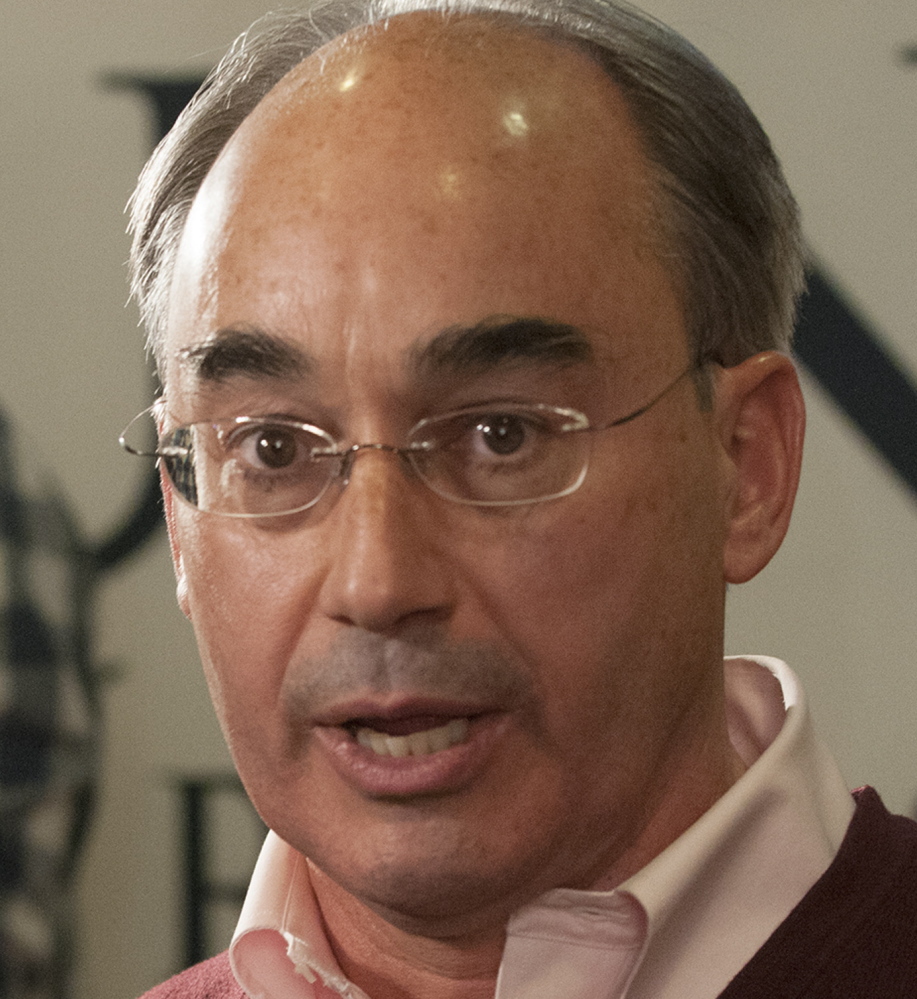

The announcement has reignited a political debate about reauthorizing financing of the bank, and directed criticism from Democrats toward U.S. Rep. Bruce Poliquin, R-Maine, a fervent critic of the bank who has cited fraud and corruption within the program.

“It’s disappointing that a big Wall Street corporation, like GE, would use politically charged language as a cover to shipping jobs overseas,” Poliquin said in a written statement. “We, as the people of Maine and citizens of the United States, cannot complain about corporate welfare at the same time we turn our backs on government corruption. This is especially true when 70 percent of the loans – which are subsidized by the taxpayers – extended help (to) a select 10 of the largest corporations.”

If GE wins a multibillion-dollar contract for its power turbines, the company will shift about 400 jobs to France from plants in Bangor, Schenectady, New York, Houston and Greenville, South Carolina, a spokeswoman said Tuesday. Another 100 jobs will be moved from Texas to Hungary and China next year if the company lands the contract.

GE hasn’t yet specified how many jobs at each site would be lost, and the cuts could be years off as the company completes existing contracts.

About 80 people in Bangor work on GE’s turbines, said Katie Jackson, a company spokeswoman. The jobs associated with the contract GE is seeking would need to be moved to France. She said it’s not clear whether contracts for other turbines could be filled by U.S. workers, including those in Bangor.

The authorization for the Export-Import Bank expired in June and the Senate passed a reauthorization in July with bipartisan support, but the House adjourned for its August recess without taking up the reauthorization. There’s some speculation that Senate supporters might try to attach it to other legislation this fall.

The bank helps U.S. companies make deals overseas by providing financial backing for the sales. For instance, a purchaser of American goods may need credit to pay, so the bank provides credit guarantees for those loans. Supporters say it makes U.S. goods more attractive to foreign purchasers, and note that most developed countries have similar financing agencies for their exports.

In Maine, the program is used only occasionally. Nine companies have split $4 million in loan guarantees this year. Nationally, the bank provided $27.5 billion in financing before closing its doors.

GE said that because it was unable to get credit aid through the Export-Import Bank, it turned to France to help underwrite the deal. France would only provide the credit if GE agreed to move the jobs there. The U.S. bank has the same requirement for exports that it backs.

If the deal goes through, GE said it will make the turbines in Belfort, France.

Poliquin has been a leading critic of the Export-Import Bank, saying there have been 48 convictions for fraud by employees and others accused of favoring some foreign companies to receive the bank’s loan guarantees.

“Sixty-six years of jail time and $224 million in fines have been dished out by the courts,” Poliquin said. “There are 37 ongoing investigations for fraud and corruption at the bank.”

The 2nd District Republican said the bank needs to “clean up its act” and if it does, he would be willing to consider reauthorizing it.

Rep. Chellie Pingree, D-Maine, blamed “tea party politics in Congress” for the House’s failure to reauthorize the agency.

“GE doesn’t want to move this work overseas,” she said, but the company needs the export credits to put a deal together. “Since the U.S. can’t do that right now and France can, the jobs and the work are going to France.”

Sens. Susan Collins and Angus King both voted for reauthorization of the bank.

“This is exactly why we voted to reauthorize the Ex-Im Bank in July,” they said in a joint statement Tuesday afternoon. “The bank provides capital for innovative export opportunities that support American manufacturing jobs. The news today is a significant blow for hardworking Mainers at the Bangor plant. We will continue to urge our colleagues in Congress to renew its charter, so that we can help workers in Maine and around the country compete internationally on a level playing field.”

Josette Pettegrew of the Trenton Bridge Lobster Pound said her family-owned company worked with the Export-Import Bank when it began exporting seafood products.

She said the bank provided a guarantee that her customers would pay for the seafood they bought on credit, but none of them defaulted, so the guarantees weren’t used. According to the Export-Import Bank, it provided the lobster pound with $20.8 million in credit for the purchases from 2010-2014.

Pettegrew said the credit provided some financial assurance as they developed an overseas market, but the lobster pound no longer works with the bank because the company now has an established set of foreign customers.

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.