Maine’s demographics, widespread unionization and workplace values are contributing to a workforce that is relatively well-prepared for retirement, according to a report issued Wednesday by the Pew Charitable Trusts.

However, the lower-than-average participation rate among Mainers with access to a company retirement plan shows that more education is needed to convey the benefits of saving for retirement, its author said.

The report, based on employer surveys by the U.S. Census Bureau from 2010 to 2014, found that Maine ranked No. 6 among the 50 states in terms of the share of workers with access to a company retirement plan. Sixty-seven percent of Maine workers have access to an employer-based retirement plan, it said, compared with the national average of 58 percent. The top-ranked state in the nation was Wisconsin, with a 70 percent access rate, and the lowest was Florida, at 46 percent.

One contributor to Maine’s high ranking is its relatively older population, said John Scott, director of Pew’s Retirement Savings Project.

“Older workers tend to gravitate toward jobs that provide retirement benefits,” he said.

Race also is likely to have played a role, Scott said. States with higher concentrations of Hispanic workers tended to have the lowest retirement-plan access rates, he said, while states with predominantly white populations tended to have the highest access rates.

That’s because a large share of Hispanic workers perform lower-wage jobs with relatively few employee benefits, Scott said.

“I think ethnicity and race matter,” he said.

Another factor was Maine’s relatively high rate of unionization, Scott said. The share of workers in Maine who belong to unions is 12.5 percent, he said, compared with 10 percent nationally.

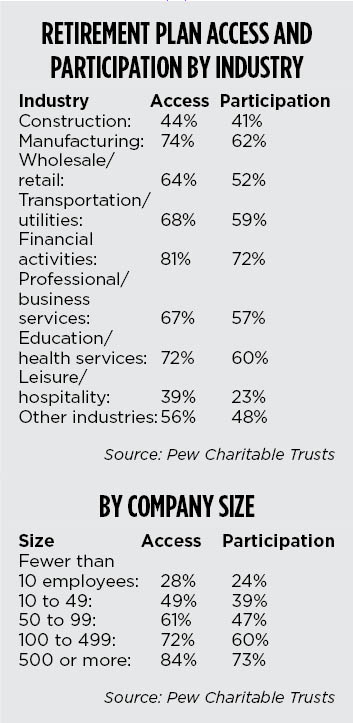

The impact of unionization can be seen when looking at access to employer-based retirement plans among particular industries. For instance, 74 percent of Mainers working in the manufacturing industry have access to a company retirement plan, compared with 69 percent nationally. (That percent may be lowered in the next survey since Maine’s paper industry lost about 700 jobs in 2015.) Maine’s educational and health services industry provides access to a retirement plan for 72 percent of its workers, compared with 55 percent nationally.

In addition to demographics and unionization, Scott said there is a noticeable cultural influence in Maine and throughout New England that tends to promote employee access to retirement savings plans. New England employers, regardless of their size or industry, simply are more inclined to offer retirement plans to their workers than in other regions of the U.S., Scott said.

“I’m fascinated by the regional aspects of this,” he said.

Among Maine’s smallest employers – those with fewer than 10 workers – the rate of access to an employer-based retirement plan was 28 percent. In Maine and across the country, the smallest employers are the least likely to offer retirement plans. However, small employers in Maine still provided better access than their counterparts nationally, where only 22 percent of workers had access to a retirement plan.

“More smaller employers in Maine are offering retirement access than smaller employers in other parts of the country,” Scott said. “All those things are bumping up Maine’s ranking.”

Maine also ranked relatively high in terms of the share of workers who actually participate in their company’s retirement plan, according to the report. It found that 56 percent of Maine workers participate, compared with 49 percent nationwide.

Maine’s participation rate was 15th-highest among the 50 states, with Wisconsin coming in at No. 1 with 61 percent, and Florida ranking the lowest at 38 percent.

Despite its strong position, the drop in Maine’s ranking from No. 6 in access to No. 15 in participation reveals a weakness: Fewer Mainers with access to a company retirement plan are taking advantage of it compared with their counterparts in other states. Overall, 83 percent of Maine workers with access to a company plan are active participants. The national median is 85 percent.

Scott said Maine’s lower “take-up rate” may be an indication that employers in the state need to do a better job of promoting their retirement plans and making sure workers understand the benefits.

Financial adviser John LeMieux, principal of Anton LeMieux Financial Group in Falmouth, said inertia may be partly to blame for the fact that more Mainers with company plans don’t set aside money for retirement. If they haven’t done so in the past, they may be reluctant – and perhaps financially unable – to adjust to slightly smaller paychecks, he said.

Still, LeMieux said the most critical factor may be that they don’t understand the potentially dire consequences of putting off their retirement savings. He agreed with Scott that more financial education is needed.

“A lot of people don’t understand how little Social Security provides in retirement,” LeMieux said. “This isn’t your grandfather’s retirement with a gold watch and a pension – we have to do this ourselves.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.