MADISON — The town of Madison has filed a lawsuit against the owners of the community’s former landmark paper mill, ratcheting up a dispute over property values and access to assessment information.

At stake are thousands of dollars in property taxes as the town struggles in the wake of the mill’s 2016 closure and the loss of more than 200 local jobs in this town of about 4,800 people.

The town of Madison says it is taking owners of the shuttered Madison Paper Industries to court to allow access by town officials and their attorneys to information, which currently is confidential, regarding the town’s assessment of the mill’s real estate and personal property.

Under Maine law, only the town’s assessor and the state tax assessor — not the town manager or selectmen — are allowed to see the tax assessments if the company does not want others to see the information, according to court documents.

Any violation of that state statute would be a Class E crime under the law.

The town of Madison, through its attorney, David Silk, of the Portland law firm Curtis Thaxter, is seeking to make those documents available to town officials so they can mount a challenge to MPI’s appeal of taxes for 2016-17. The object of the filing in Somerset County Superior Court is to have a judge declare that the confidential information is no longer “proprietary” information because Madison Paper “appears to no longer be in business,” according to court documents.

Proprietary information includes such things as trade secrets or production, commercial or financial information which, if released, would impair the company’s competitive position on the global market.

“What the town is trying to do with this lawsuit is find a way so that the other folks besides the Board of Assessors can look at this information,” Silk said. “The Board of Assessors believe that the information is relevant to the valuation of the mill.”

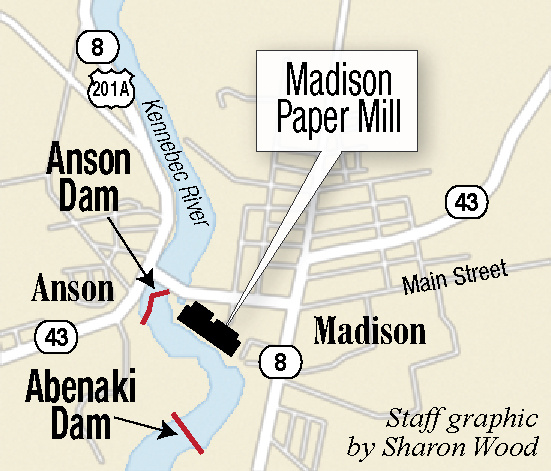

Madison Paper Industries closed in May 2016, putting about 215 people out of work. The mill, a producer of supercalendered paper used for magazine publishing, had been in Madison since 1978 and was producing about 195,000 tons of paper annually at the time the closure was announced.

Madison Paper Industries is still a legal entity, Silk said by phone Thursday. Court paperwork lists the company as a partner of Northern SC Paper Corp. with an office on Memorial Circle in Augusta.

The town, through its attorney, Silk, recently filed a motion for entry of an order to allow the documents to be viewed by town officials during a time when MPI is appealing its tax assessment before the state Board of Property Tax Review. The mill’s valuation has dropped by about $8 million since the closure was announced, and it is currently valued at $72,362,681.

The tax rate in Madison for 2015 was $19.50 per $1,000 of assessed valuation. The tax rate for 2016 was estimated to be $21 per $1,000 of assessed valuation, meaning the mill owes about $1.5 million in property taxes to the town.

The thousands of dollars at stake is the difference between what the town says the mill is valued at for taxation and what the mill owners say it should be valued.

Madison Town Manager Tim Curtis did not return calls for comment on the tax rate or the lawsuit.

Compounding the matter of confidentiality is the fact that the Board of Assessors — the only municipal partner allowed to see MPI’s valuations — is comprised of the same people who sit on the Board of Selectmen.

Madison voters in February 2015 voted to abolish the Board of Assessors and transfer its duties to the Board of Selectmen. That decision allows selectmen, who are charged with creating a municipal budget, to access information that will inform them better in creating a budget. According to a 2014 Maine law, assessors are required to maintain confidentiality about assessments for a major taxpayer requesting a change in valuation.

That will have to be settled in court.

In email exchanges with Silk, attorney Jonathan Block at PierceAtwood in Portland, said the language of the law is clear: “An assessor of the taxing jurisdiction may not allow the inspection of or otherwise release such proprietary information to anyone other than the State Tax Assessor,” subject to exceptions noted in the statute.

Any other sharing of the information would be a violation of law, Block states.

Doug Harlow — 612-2367

Twitter:@Doug_Harlow

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.