Samantha Merrill said when she opened a letter last week from Maine’s Affordable Care Act marketplace, she knew it was going to be bad news about her 2026 premiums.

It was worse than she anticipated.

Merrill, 59, of North Berwick, said the letter indicated her premiums would jump from $478 to $1,262 per month if ACA tax credits, which help pay health insurance premiums for millions of Americans, expire this year. That would amount to more than $15,000 per year for health insurance, of her $65,000 annual income as a self-employed mental health counselor.

“I knew it was going to be bad, but when I saw it, I thought, ‘How am I going to do this? Is it even possible?” Merrill said.

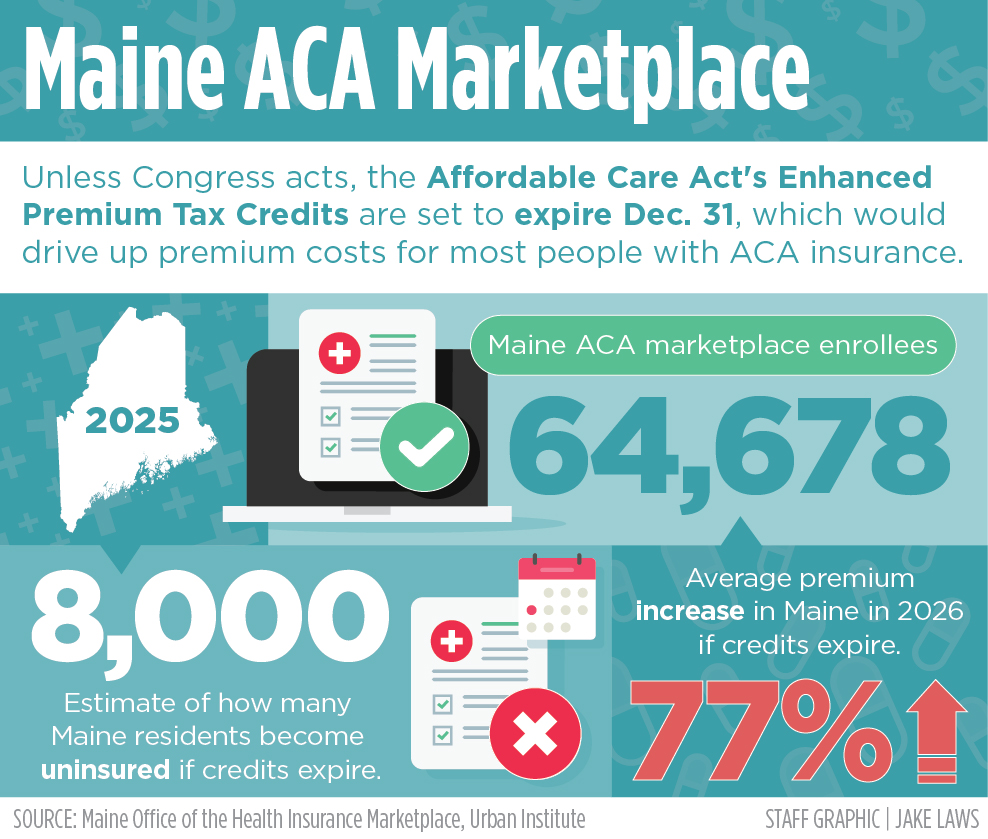

If Congress doesn’t extend the subsidies — called Enhanced Premium Tax Credits — by Dec. 31, premiums for ACA plans are set to skyrocket in Maine and across the country. In Maine, the average premium would increase 77%, according to the Maine Office of the Health Insurance Marketplace.

Nearly 65,000 Maine residents are on health insurance plans purchased through the marketplace. That includes people who are self-employed or don’t have plans offered by their employer.

Most receive the subsidy and may have sticker shock as they shop for plans, with open enrollment having started Saturday on the state’s online health insurance marketplace. Mainers can browse the website — www.coverme.gov — to see how much ACA health insurance would cost for 2026.

The amounts on the website now and what enrollees actually pay in January could be quite different if Congress restores the subsidies.

Some families, depending on their income, age and where they live, will see premiums double, triple or even quadruple. A projected 8,000 Maine residents would become uninsured in 2026, rather than pay the higher premiums, according to an estimate from the Urban Institute, a national think tank.

Hilary Schneider, director of Maine’s health insurance marketplace, said the “impact would be devastating.” She said people may go uninsured or purchase plans with higher out-of-pocket costs.

Long term, Schneider said, having fewer people in the ACA insurance pools will put more upward pressure on costs.

“The people who choose to go uninsured will be mostly young, healthy folks,” Schneider said. “As younger people move out of the market, that drives up insurance costs for all of us. We will see a spiral of increasing costs for everyone who remains covered.”

Those increases could be avoided if Congress extends the subsidies — and whether to do so is at the center of the federal government shutdown. Republicans argue the shutdown should end before negotiations over extending the tax credits begin. Democrats say extending the subsidies should be part of the negotiations to reopen the federal government.

For Merrill, who is single with two adult children, the increased health insurance costs would make it difficult for her to pay down $65,000 in student loan debt. Merrill said she went back to graduate school later in life to pursue her dream of opening a small business as a mental health counselor.

“I would likely have to shutter the doors of my business and go back to working for a company” to get employer-based health insurance, said Merrill, who became self-employed about five years ago. “You like to think that if you work hard and make the right decisions, that you’ll be rewarded.

“In this case, it’s a giant plot twist.”

‘WHAT ARE WE GOING TO DO?’

Maine residents like Ossian Riday are waiting to see whether they will have to pay much higher premiums in 2026.

Riday, 54, a self-employed software developer from Topsham, said his premiums would go from about $675 per month for a household of three, to $2,000 monthly. That’s for a bronze plan, the cheapest available, with high deductibles. He said his family is healthy and doing well financially, so they can afford the higher costs, but for many the increases would be a struggle.

“What are we going to do? I don’t know, but something has to give,” Riday said. “These numbers are staggering.”

The expanded ACA tax credits were first approved in 2021 and then extended through 2025, when Congress passed the Inflation Reduction Act in 2022.

Experts credit the Biden-era subsidies with expanding the reach of the ACA, with 23 million Americans now enrolled in an ACA plan, compared to 11.2 million in February 2021, just before the law passed creating the new enhanced tax credits.

In Maine, ACA enrollment has grown at a more modest pace, from 59,738 enrollees in 2021 to 64,678 this year, largely because the state expanded Medicaid in 2019. People who are eligible for Medicaid are barred from enrolling. States that did not expand Medicaid, such as Texas and Florida, have experienced larger gains in ACA enrollment.

Eighty-five percent of Maine’s nearly 65,000 enrollees have enhanced tax credits, but because of the way they are structured, people in their 50s and older, those at the lowest income brackets and those at the higher-end income brackets would see the greatest premium increases.

The enhanced tax credits also created a rule that caps the amount spent on premiums at 8.5% of household income, shielding higher-income earners from prohibitively expensive premiums.

“The impacts of these tax credits not being extended will be pretty extreme for people who get their insurance through the ACA marketplace,” said Emma Wager, senior policy analyst for KFF’s Program on the ACA. KFF is a national health policy think tank.

Wager said those who make more than 400% of the federal poverty level — or $106,600 for a family of three — will see the most extreme increases because they will lose all of their tax credits.

“These are often people who tend to be independent workers or have started a small business,” Wager said.

U.S. Rep. Chellie Pingree, D-1st District, said some people will be priced out of health insurance, including many who started small businesses believing that ACA insurance would be affordable.

“This will have a broad impact,” Pingree said, in an interview with the Press Herald on Wednesday. “It hits a lot of small business owners, farmers, fishermen. The ACA and these subsidies have made it possible for people to leave their previous job and start a small business.”

OPEN ENROLLMENT

Ann Woloson, executive director of Consumers for Affordable Health Care, which helps people navigate the ACA marketplace, said that, while premium costs currently are high, there would still be time to shop if the tax credits are extended.

Open enrollment at Maine’s ACA marketplace online started Saturday and runs through Dec. 15 for plans that start on Jan. 1, and through Jan. 15 for plans starting on Feb. 1.

Schneider said Maine’s marketplace is anticipating that Congress may decide to extend the subsidies, so the website will be updated to reflect the reduced premium costs if the credits are approved.

“If the premium tax credits are extended in their current form, we have designed the system to include them again, so that it is nearly as easy as a flip of a switch,” Schneider said.

If Congress extends the tax credits, but alters the rules around who gets them or how generous they are, Schneider said, it will take longer to update the website, but they are ready to do so as quickly as possible.

Pingree said she remains hopeful Congress will extend the credits, and she expects the pressure will mount once more people start shopping for plans and see their premiums soar.

“Once it becomes real to people, it will help kick negotiations into overdrive,” Pingree said. “People will become vocal and call their member of Congress and say ‘What the heck is going on?'”

Chelsea Avirett, 45, of Rockland, said her ACA plan, which covers herself and her husband, is set to increase from about $1,100 per month to $1,500 if the credits aren’t extended.

“That will be more than our mortgage payment, so it’s a bit appalling,” said Avirett, who is self-employed and runs an online job board. “It’s really challenging for small business owners who don’t have any other options for health insurance.”

Woloson said even if Congress fails to extend the Enhanced Premium Tax Credits, there are still other tax credits — the original tax credits that were passed when the ACA first launched in 2013 — to help people afford coverage.

“It’s going to be confusing, it’s going to be complicated,” Woloson said. “But our hope is that Mainers will still shop and look at their options. The good news in Maine is that there’s lots of help available.”

Consumers for Affordable Health Care has a team of ACA navigators who can help guide people through the process of enrolling. Call 800-965-7476 for assistance.

For more information, or to shop for ACA plans, go to www.coverme.gov.

We invite you to add your comments. We encourage a thoughtful exchange of ideas and information on this website. By joining the conversation, you are agreeing to our commenting policy and terms of use. More information is found on our FAQs. You can modify your screen name here.

Comments are managed by our staff during regular business hours Monday through Friday as well as limited hours on Saturday and Sunday. Comments held for moderation outside of those hours may take longer to approve.

Join the Conversation

Please sign into your CentralMaine.com account to participate in conversations below. If you do not have an account, you can register or subscribe. Questions? Please see our FAQs.