AUGUSTA — Keith Ludden looks out his living room window and worries about the foot-tall grass, peeling paint and other obvious signs that the house across the street in his otherwise well-kept neighborhood is vacant could attract vandals, thieves and varmints.

He worries that the unmaintained house, and others like it in neighborhoods around the city, not only lower the value of the homes near them, like his, but also could act as a deterrent to people and businesses considering a move to Augusta.

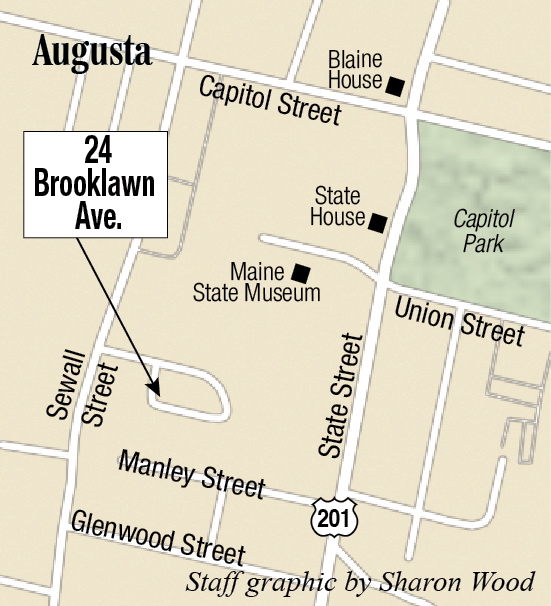

“How long is it going to be until that is discovered by squatters, small animals, or what have you?” Ludden said of the ranch home that is across Brooklawn Avenue from his home in a neighborhood of closely spaced middle-class houses. “It’s getting very obvious this property is abandoned. It may not be that bad yet, but I fear if it sits vacant through another winter, it’ll look a great deal shabbier next spring and be even harder to sell. And thus continues the spiral, down. This is a good neighborhood. I’d like to keep it that way.”

The home has been vacant since November, when, Ludden thinks, it was foreclosed upon. Kennebec Country Registry of Deeds records indicate the home is in foreclosure. A notice on the door indicates the locks have been changed. So Ludden believes that even if his old neighbor wanted to maintain the home, she couldn’t, because she’s been locked out.

Ludden laughs and laughs when asked if he tried to contact what he believes to be the lender that foreclosed on the home — Ocwen, a nationwide firm that describes itself on its website as the industry leader in servicing high-risk loans.

“Just try to get on the phone with them. It’s phone tree city,” Ludden said, after his laughter subsided. “Good luck.”

Ocwen officials could not be reached for comment last week. An email form on the company’s media relations website indicates inquiries will be responded to “within a few business days.”

Ludden approached the Augusta City Council last week to ask them to adopt property maintenance standards, and enforce them, or find some other way to apply pressure to lenders who foreclose on properties to get them to spend the money needed to maintain homes they seize.

“Lenders are being allowed to game the system when it comes to property maintenance,” he said. “They leave the former tenants’ name on the deed, but the former tenant is locked out, so they can’t do maintenance there if they wanted to. And the lender can say, ‘It’s not our problem.’ I’d like to see the city explore some higher standards for property maintenance, and ways to get lenders like Ocwen to fish or cut bait. Either put the property up for auction and make it available to someone who will maintain it, or take care of the property.”

Ward 2 City Councilor Darek Grant said the house in Ludden’s neighborhood is probably the third or fourth such situation he’s learned of just in the last couple of years.

One of the challenges is within the foreclosure process “there is that weird gray area where no one wants to take responsibility, where the house or property is in limbo with who owns it,” Grant said. “It goes on for a year or so. You start to see a lot of property like that fall into disrepair. It’s a problem. It can become a public safety issue, and it drives down everyone else’s property values.”

Grant said the city has to be careful not to infringe on people’s or companies’ property rights, nor to set overbearing standards that would put the city in the position of policing how often residents mow their lawns.

“There’s a fine balance of government telling people what they can do with their property,” Grant said. “We don’t want to cross too far over that line; but when there are safety concerns, when properties are abandoned and in disrepair, you have to find common ground.”

Councilors agreed to form an ad hoc committee to study the issue and make recommendations on how to address it.

At-Large Councilor Cecil Munson said the city’s current rules for property maintenance don’t allow the city to do much to require properties be kept up, unless they become a threat to public safety.

“We had a situation last year on Perham Street, a bank-owned home with a swimming pool that had dead animals and stuff in there,” Munson said. “We had to secure the swimming pool, to make it safe. That’s the one thing the bank would do, put orange webbing on the pool. And we had to force them to do even that.”

Tom Connors lives next to a Hutchinson Drive home in the city’s large Mayfair neighborhood, which he said has been empty for the last year. Kennebec County Superior Court records indicate the home was foreclosed on by TD Bank. The home, as of last week, had grass more than a foot tall surrounding it. Connors said the fence surrounding it is broken, and a camper trailer with no wheels is parked between his property and the home.

Connors said a neighbor contacted TD Bank to offer to mow the lawn of the vacant home himself, at no charge, and he and his wife previously had raked up leaves on the vacant property, to make the neighborhood look better, and because the leaves were likely to blow over into their yard anyway.

“The bank told us to stay off the property and said we could be charged with trespassing if we didn’t,” Connors said. “There was a guy who came over that changed the locks in the fall. He told me they were coming back in the spring and were going to mow it, move the wood, get rid of the camper and fix the fence. Those guys never came back.”

Connors said in the spring a transient woman who neighbors believed was living in woods nearby stepped through the broken fence and was spotted pulling on the back doors to the home. Connors is sure she was trying to get in.

Police later arrested her for trespassing.

Connors said another neighbor is trying to sell his “immaculate” home near the vacant home, and he’s concerned anyone coming to look at his property to consider buying it could be scared off by the vacant, unmaintained home they’ll pass just before they get to the one that’s for sale.

“There are homes like this in every neighborhood in Augusta,” Connors said. “There was one on Windy Street that was vacant for a couple of years, that had water in the basement and raccoons living in the garage. I don’t think we need to get to the extreme where you need to be yard police, but there’s a happy medium here. The banks need to be held accountable.”

Connors said he’d heard the vacant home was the subject of an auction last week, but he said on Friday that he hadn’t seen any activity there yet.

Kate Toy, communications manager for corporate and public affairs for TD Bank, one of the 10 largest banks in the country, said she could not provide information on the specific property in Augusta because it is not owned by TD Bank now.

“However, I can share that following standard foreclosure proceedings: TD Bank employs third-party property managers to provide active management, oversee the security of the property and execute any necessary maintenance or repairs,” Toy said.

She noted that TD Bank, despite the economic downturn that caused the number of foreclosures to spike over the last several years, “has not experienced the same delinquency issues that other lenders have faced. In fact, the strength of TD Bank’s mortgage loans continues to be a positive outlier versus the rest of the mortgage industry.”

Ludden said he has lived in other communities, and they all had some form of property maintenance standards. He said he wouldn’t want such rules to go too far — acknowledging that his own home, like most people’s, could use some repairs here and there, but added that there must be a way to force banks that take possession of property to do at least minimal maintenance on them.

City Manager William Bridgeo said officials have discussed property upkeep standards before, several years ago, but there was significant opposition from people who anticipated such standards could go too far. He said the rules that emerged don’t give the city any power to require lawns or shrubs to be maintained in any way. He said the current rules address only health and safety issues.

Stephen Langsdorf, city attorney, said it is a difficult issue because property owners have constitutional rights, but the city could work on an ordinance with reasonable standards.

“We’ve talked about, in the past, a property maintenance ordinance; but there was not support for that then,” Bridgeo said. “I think Augusta is now probably ripe for some tweaks, especially relative to properties in foreclosure. We’ve had a number of instances in recent years where banks that have the wherewithal just won’t provide the resources.”

Keith Edwards — 621-5647

kedwards@centralmaine.com

Twitter: @kedwardskj

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.