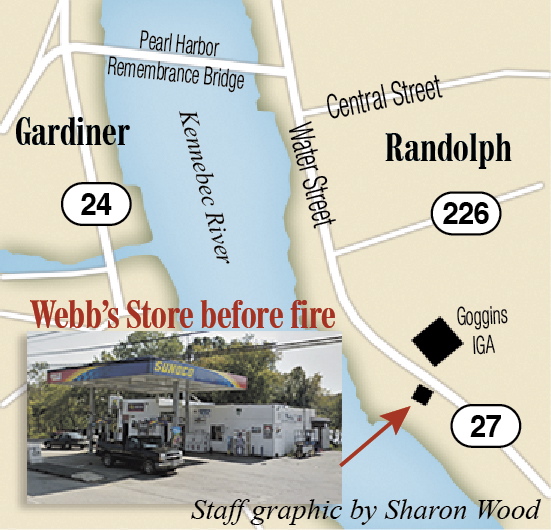

The former Webb’s Store in Randolph, destroyed by a fire in March, will reopen later this year as Damon’s Quick Stop, part of a group of seven family-owned stores in the central Maine area.

The rebuild of the Route 27 store along the Kennebec River has required more complicated, and expensive, measures because it falls in the federal floodplain. If the cost of building repairs total at least 50 percent of the building’s value or if the damage is worth at least 50 percent of its value, the building must be brought up to the federal flood insurance program and local ordinance standards.

The owners of the building are floodproofing it to a foot above the floodplain, the requirement in most Maine communities.

This means they’ve had to construct a 30-inch-thick concrete slab as the foundation and 10-inch-thick concrete walls, according to Jeff Damon, one of the building owners. Otherwise they likely would have just installed a typical 6-inch-thick slab and wood walls, he said.

As of Friday, workers had built the exterior walls and were in the process of constructing the roof. Damon, of Skowhegan, said he’s shooting for a mid-November opening, but it may be closer to the start of December.

Damon said the town of Randolph has been very helpful in working with the business on the building process and the floodplain issues.

“To me, that’s a big deal because not all towns are like that. Believe me,” he said.

The family also owns stores in Augusta, Chelsea, Skowhegan and Waterville. It’s the third time the family company has built a new structure, but the first time it’s been in a floodplain, Damon said.

He said the store will be similar to Webb’s Store, a gas station and convenience store. It will likely employ 10 to 15 full- and part-time workers, he said. Damon’s already spoken to at least one person who worked at Webb’s Store and expects to begin hiring people in about a month, he said.

Besides the thicker-than-usual concrete, the building must have a way to block the doors and windows if there’s a chance of flooding.

Damon wouldn’t say how much more expensive the floodproofing made the rebuild other than calling the cost increase “significant.”

His family’s company, JRS Associates Inc., bought the property in July for $130,000, according to town records. The building proposal filed with the town lists the estimated value of the proposed development as $300,000.

The previous owner, Dan Kilmer, couldn’t be reached for comment. He told the Kennebec Journal in April that he planned to rebuild the store. The Office of State Fire Marshal said the fire was accidental and possibly caused by the number of electrical systems and a ceiling-hung heater near where the fire started.

The building is in the 1 percent floodplain, meaning there’s a 1 percent chance in any given year that the river will flood that high. The last time that happened was the April 1987 flood that caused more than $74 million in damage statewide, according to the U.S. Geological Survey.

Besides being in the base floodplain, the building is in the floodway, the area of land designated for discharging flood water. New structures built in floodways generally need engineer calculations showing they won’t raise the base flood elevations, according to Sue Baker, state coordinator for the flood insurance program. But because this building is within the footprint of the former structure included in the previous calculation, a new calculation wasn’t needed, she said.

Buildings built before a community adopted its first flood map — 1979 in Randolph’s case — are grandfathered from the elevation requirements. However, grandfathered buildings in the floodplain will have significantly higher flood insurance rates without federal subsidies. After a 2012 change to the federal flood insurance program scaling back some of those subsidies caused steep premium hikes for some building owners, lawmakers updated the law in March to restore most subsidies.

Although subsidies were restored for most businesses and homes, the premiums for buildings in the floodplain are still expected to slowly increase until they reflect the actual risk of the properties.

Because dry floodproofing minimizes the risk for damage, buildings meeting floodproofing standards should have reasonable flood insurance rates, Baker said.

As a nonresidential building, it could have been dry floodproofed to a foot above the floodplain or elevated to that height. Most Maine communities require buildings to be 1 foot above the floodplain, but some require two or three feet, Baker said. The Federal Emergency Management Agency only requires buildings to be at the floodplain level, she said.

Paul Koenig — 621-5663

Twitter: @paul_koenig

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.