RUMFORD — There’s a modern, efficient power plant in an industrial park here that can generate enough electricity to serve roughly 250,000 homes. It’s well maintained and ready to run 96 percent of the year. But over the past 12 months, Rumford Power was online only 30 percent of the time, including periods last winter when demand during a record cold spell strained the region’s electric grid.

The situation is likely to be much the same this winter, when the need could be even greater. A nuclear power plant in Vermont and coal and oil plants in southern New England are shutting down, further diminishing the region’s generating capacity and contributing to soaring electric rates.

So why is Maine’s fifth-largest power plant idle so often? And what could allow it to run more frequently?

Those questions are at the crux of the public and political debate over spending billions of dollars to expand New England’s natural gas pipeline capacity. What’s happening in Rumford sheds light on the complexities of power generation and the natural gas market, and the challenges involved in expanding the flow of gas into Maine – a move that has the potential to reduce energy costs for thousands of homeowners and businesses.

Part of the answer revolves around what happens here every day at 8:30 a.m.

On a Tuesday morning in mid-November, three operators at the Rumford plant and Scott Fortuna, the plant’s manager, are on a conference call. Leading the call is a power trader with Emera Energy in Halifax, Nova Scotia. Also on the line are power plant operators in Bridgeport, Connecticut, and Tiverton, Rhode Island.

Emera is a global energy company that owns the major electric utilities in eastern and northern Maine. Last year, its energy subsidiary bought the trio of natural gas-fired power plants for $541 million.

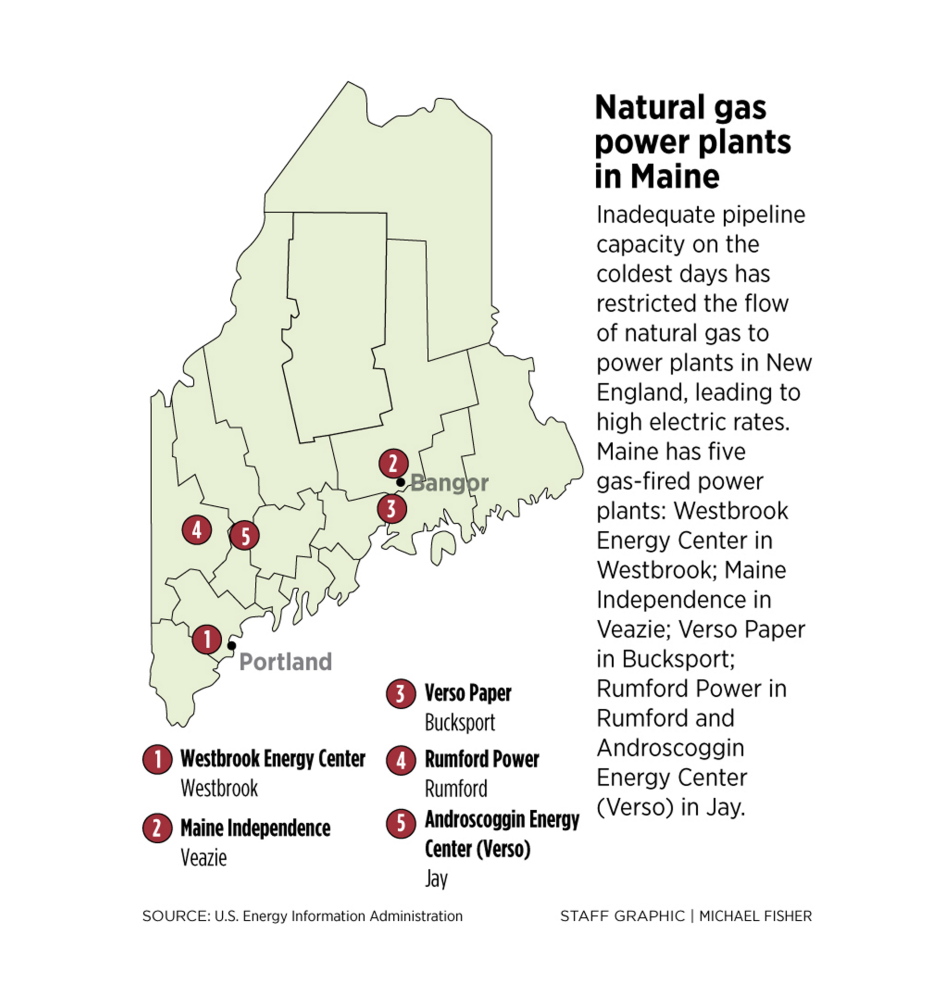

High-efficiency, natural gas-fired plants are the backbone of power generation in New England today. Roughly half of the region’s electricity is generated by gas plants, including five in Maine.

On the conference call, the power trader in Halifax asks for operations status reports, first from Bridgeport, then Tiverton. Bridgeport’s 520-megawatt unit is still offline for a two-month equipment upgrade. Tiverton, Rumford’s 265-megawatt twin, also is down, for scheduled maintenance.

Autumn is a common time for power plants to get work done, between the high demand for summer air conditioning and the coming winter surge for light and heat. But this mid-November week’s unusual cold, coupled with a 35-degree high temperature expected in Boston the next day, is creating winterlike conditions.

Rumford, however, is ready to run.

RUMFORD FACES CHALLENGES

“And the jewel of northern Maine, Rumford?” says Tom Cassidy, the power trader in Halifax, as he checks in with Fortuna and his staff.

Cassidy and his team in Halifax have a complicated job. They have to estimate what the wholesale cost of natural gas will be tomorrow. They must find a gas supply for each power plant. They then can offer a certain amount of power to the regional grid operator, based on what New England’s needs are expected to be the next day. And they have to make the deal at a power purchase price that will turn a profit.

This process, called the Day-Ahead Market, was developed to smooth price spikes on New England’s largely deregulated electricity landscape. But it’s tricky, because gas prices can change between the time a power plant is selected by the grid operator, ISO-New England, and when the gas actually is purchased. An increase of a dollar per unit of gas could cost Rumford $30,000 a day, for example.

Rumford faces other challenges.

The power plant is located on a lateral line off the Portland Natural Gas Transmission System. It was built in 2000, on the path to paper mills in Rumford and Jay. At the time, developers assumed most of the gas supply would flow from western Canada. They couldn’t anticipate that a decade later, massive gas deposits in Pennsylvania shale formations would eclipse the Canadian supply and set wholesale prices for the region.

So Rumford now is at a disadvantage. While other plants are closer to the prime supply and near the interstate highways of gas supply, Rumford is far away, on the equivalent of a country road.

That’s a problem in cold weather, when demand for heat and electricity is high. Specifically, gas-fired power plants represent 11,000 megawatts of operating capacity in the region. On the coldest days, pipelines can support less than half that output, according to ISO-New England.

“The biggest problem with Rumford,” Cassidy said in an interview, “is when there’s high gas demand elsewhere on the system, Rumford’s gas tends to get constrained and expensive. You need gas at the right place and the right time, but also the right price.”

RESPONSIVE TO MARKETPLACE

One indicator is a daily online market snapshot compiled by Emera. It shows trends for average wholesale prices of power and pipeline gas, along with the average market heat rate, an efficiency measure of the amount of energy a power plant needs to turn fuel into electricity. By comparing a plant’s heat rate with the average market heat rate, traders can get a sense if they can make a competitive bid to run.

Following the morning call, Cassidy and the Halifax team put together a deal for Wednesday, the day ahead. Tuesday afternoon, the plant learned that its previous bid had been accepted. Under the terms of that award, the plant ran overnight and through the next day, shutting down Wednesday at 9 p.m.

Some generators, notably nuclear plants, run 24/7 for baseload power. But gas-fired plants such as Rumford are part of a fleet of so-called merchant plants that must be agile and responsive in changing energy markets. For example: Under an award from the previous day, Rumford was asked to produce power on Tuesday starting at 4 p.m. That’s when many people were coming home on an unseasonably cold, dark evening.

“It’s almost impossible to predict the future based on the past, because there seems to be a new normal every week,” Fortuna said. “Perhaps afternoon startups may become more normal for us, as the super-peak is clearly around and just after supper.”

DISAGREEMENT OVER SOLUTION

Rumford’s inability to run more often is tied up in current events.

In a recent seasonal update, ISO-New England reported that the region will have sufficient power this winter. But that’s only because of a 2-year-old “reliability” program, in which oil-fired generators are given financial incentives to stockpile fuel for periods when there’s not enough natural gas. Last winter, oil and coal plants literally helped keep the lights on. The pipeline crunch will persist this winter and have varying degrees of impact on Maine’s five gas-fired power plants – in Rumford, Westbrook, Veazie, Bucksport and Jay.

“Most gas-fired generators do not have firm contracts for natural gas delivery and instead rely on the release of spare pipeline capacity from gas utilities,” the ISO noted in its update. “With increased residential and business conversions to natural gas for heating, spare pipeline capacity is often not available for power plants.”

Markets and government officials are responding to the problem, but the solution is in dispute.

Three gas pipeline companies have announced multimillion-dollar plans to expand in New England over the next few years. In Maine, the Public Utilities Commission is in the midst of a landmark case to decide whether electric customers should be charged up to $75 million a year to help pay for new pipeline capacity. Supporters say customers will come out ahead, with lower electric rates.

Environmental groups are fighting that idea, largely because they favor renewable energy over natural gas. But the New England Power Generators Association, which represents Emera, also opposes it. The trade group maintains that the private sector is stepping up to ease the supply problem. Beyond gas, four transmission line proposals are competing to bring hydroelectricity from Canada.

“Government must resist the temptation to pick winners and losers, repeating the policy mistakes it made in the 1970s and 1980s that led to massive (costs) paid by consumers,” the group says in a new position paper.

Dan Dolan, the group’s president, said in an interview that it’s unreasonable for import-dependent New England to expect gas prices that are as low as those in gas-producing regions. But the new, private investments, he said, are poised to lower rates for both heating and electricity in the years ahead.

“It’s hard right now, but we’re in a transition period,” Dolan said.

Dolan’s free-market solution is rebutted by an organization that represents the six New England governors on power planning, the New England States Committee on Electricity. In a response two weeks ago, it pointed out that higher gas prices result in higher electric prices, which is why power plants favor the status quo. It also said there’s no evidence that any proposed pipeline projects will build enough capacity to boost gas supply to the plants, without state support.

NO CHANGES THIS WINTER

This debate will continue, but regardless of the outcome, nothing will change this winter. So every day, Emera’s power traders will calculate whether they can offer output from Rumford. More days than not, it’s not likely to happen.

Meanwhile, 81 oil and dual-fuel power plants have signed agreements with ISO-New England to stockpile a total of 4 million barrels of oil. Last winter, natural gas prices shot up so high on cold days that it was cheaper to burn oil than gas. On several days, there was little choice.

In its seasonal update, the grid operator noted: “Most significantly, on certain cold days, the natural gas pipelines in New England were running at maximum capacity, but very few gas fired generators were producing power, signaling that the gas was being used for other purposes, most likely to heat homes and businesses.”

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.