A new program coming to Maine aims to help low-income people file for bankruptcy and gain a fresh start financially.

The program, called Upsolve, uses an online service to help people gather the information needed to prepare documents for bankruptcy filings, followed by a few hours with a bankruptcy lawyer to review the documents and get the filer ready for a bankruptcy court appearance. Then the filer can submit the documents and start the process of trying to relieve his or her debt burdens.

“There’s a huge problem in this country where millions of people who face huge debts have this lifeline available to them – bankruptcy – but they can’t afford to access it,” said Rohan Pavuluri, a 22-year-old Harvard senior who developed the system with Jonathan Petts, a New York lawyer who has clerked for bankruptcy judges and provides free legal help on bankruptcies for low-income people.

Pavuluri and Petts rolled out the nonprofit service a year ago and it’s now in use in about 10 courts around the country. The software, along with lawyers providing free assistance on behalf of lower-income people, is key to helping people who are facing desperate financial issues, said Pavuluri. Filing costs and lawyer’s fees start at about $1,500 and climb from there – putting bankruptcy out of the reach for many people.

“We give people rights, but we sometimes make it impossible to access those rights,” he said. “It’s as bad as the law not existing in the first place.”

In Maine, Upsolve is just starting. Juliet Holmes-Smith, executive director of the Maine Volunteer Lawyers Project, said her organization is screening potential users of the service.

What Pavuluri and Petts developed is similar to computer tax preparation programs. Users are “interviewed” by the computer program, which gathers material on income, debts, credit ratings and taxes and then transfers that information to forms that need to be filed with the bankruptcy court.

Pavuluri said that represents 80 percent of the process of filing for bankruptcy. After the forms are ready, the filers sit down with a bankruptcy lawyer for two or three hours of free aid to go over the forms and get an overview on what is likely to happen in court.

The users then make the bankruptcy filing as individuals, without a lawyer handling the case.

FOCUSED ASSISTANCE

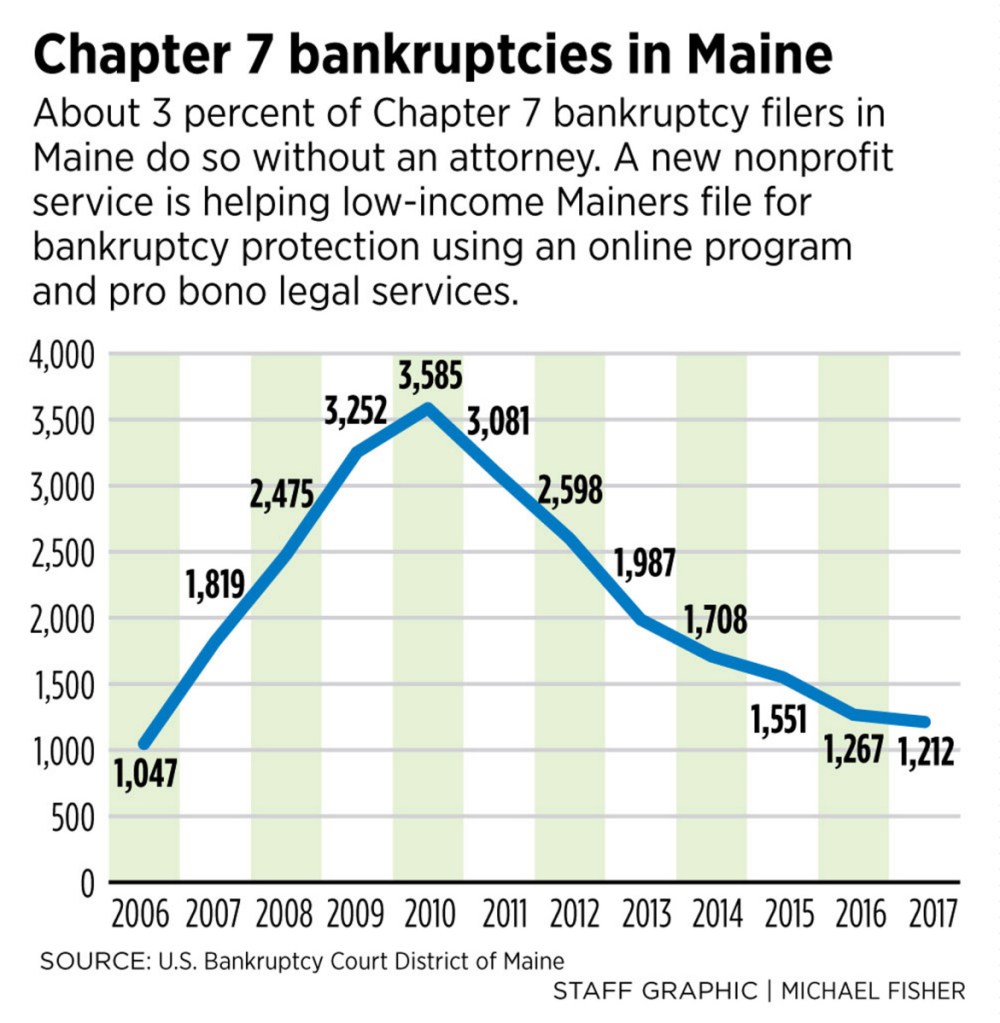

In Maine, there were 1,212 Chapter 7 bankruptcy filings in federal court last year. Chapter 7 is a typical filing status for individual bankruptcy and allows people to discharge many of their debts. Bankruptcy laws were changed in 2005 to introduce a means test to weed out higher-income people seeking to avoid paying their debts.

Chapter 7 bankruptcy filings in Maine peaked during the recession, with 3,585 cases filed in 2010. Two to 3 percent of Chapter 7 filings in Maine are pro se, meaning initiated by individuals without a lawyer, said Alec Leddy, the clerk of the U.S. Bankruptcy Court in Maine.

The Upsolve program in Maine will be administered by Pine Tree Legal Assistance and the volunteer lawyers program.

Holmes-Smith said her group tries to link low-income people in need of help on a bankruptcy filing with lawyers offering free assistance, but that effort involves many hours and stretches resources. Using the new program, “we might be able to help a lot more people,” she said.

Initial cases will likely involve filers who don’t own a house or have a lot of assets, she said, explaining that such ownership and assets make for much more complicated cases.

Many of those who file, or should file, for bankruptcy in Maine are the working poor, Holmes-Smith said. Often, they live paycheck to paycheck, and a layoff or big medical bills swings them from just getting by to facing mounting debts.

“Their budget gets wiped out,” she said.

Bankruptcy is supposed to be a way out, she said, but many don’t realize it’s available to them and are afraid of high costs and complexity.

“It’s tough for people. It feels shameful and embarrassing and it’s hard. Most people who call us have tried really hard to dig themselves out of the hole and are really desperate by the time they come to us,” she said. Bankruptcy is a way “to make sure that people can survive and make a new start.”

Upsolve, she said, should help reduce the complexity and, for those with low incomes, relieve anxiety over a new financial obligation.

“This is a new way of doing bankruptcy,” Holmes-Smith said.

Edward D. Murphy can be contacted at 791-6465 or at:

emurphy@pressherald.com

Send questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.