WATERVILLE — A project to develop 132 apartments in two buildings at 6 and 8 Water St. in the former Lockwood Mills complex could start next year if the Planning Board on Monday approves final subdivision plans and the City Council on Tuesday finalizes a proposed tax increment financing plan for the development.

Garvan Donegan, director of planning and economic development for the Central Maine Growth Council, has worked on the project with officials of North River, which owns the buildings, for two years and says it dovetails with conversations that have been ongoing in Waterville, Mid-Maine and throughout the state about the housing shortage and need for quality housing. The mill buildings have remained vacant and dilapidated for decades and developers have tried to renovate them but have been unsuccessful because of their size and the complexity of such projects, according to Donegan.

“It can’t be overstated how important this project is to this region, the downtown and the city, to breathe life back into these mill buildings,” Donegan said.

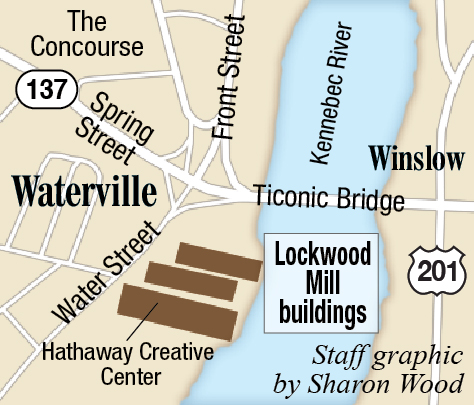

The Planning Board will meet at 7 p.m. Monday in the Chace Community Forum at Bill & Joan Alfond Main Street Commons at 150 Main St. to consider preliminary and final plans for the development, proposed by North River Lockwood I LLC. The buildings are adjacent to the Hathaway Creative Center at 10 Water St., also owned by North River.

The council will meet at 6:45 p.m. Tuesday in the same location to hold a public hearing on a tax increment financing proposal for the mill project, and at 7 p.m., the council will consider final votes on the TIF district and plan.

“They’re looking for subdivision approval for Mill 1 and Mill 3, and I don’t think there are any issues,” City Planner Ann Beverage said Thursday of the Planning Board’s review of the project. “They have numbers showing that they have adequate parking.”

The Planning Board could approve the project, approve it with conditions or reject it.

The City Council on July 16 took the first of two needed votes to remove 6 and 8 Water St., which are referred to as Mill 1 and Mill 3, the two northernmost former Lockwood mill buildings on Water Street, from the current downtown tax increment financing district and create a new TIF district for the buildings, which are scheduled to be redeveloped into retail and commercial space on the first two floors and apartments on upper floors. The city took similar action for the Bill & Joan Alfond Main Street Commons building and buildings on Main Street downtown owned by the DePre family.

Councilors voted 7-0 to remove the buildings from the current TIF District, and 6-1 to create a new TIF district for the buildings, with Councilor Phil Bofia, R-Ward 2, opposing the move.

The city’s TIF Advisory Committee recommended a 30-year TIF for the Lockwood buildings that would reimburse the owner, North River Co., 75% of the taxes it pays the city, but Bofia said at the time that he wanted to see that number reduced to 50% and that is why he objected.

Housing stock is extremely old in Waterville, with more than half built more than 60 years ago, according to Donegan. A housing shortage is an inhibitor to growth, he said, and it is important to have housing in order to attract talented workers and businesses to the area. The Lockwood buildings to be developed would have 9,000 to 10,000 square feet of commercial space, creating an opportunity for businesses to come in, he said.

“It’s a very important lever in economic development,” Donegan said. “Housing is critical.”

Mariah Monks, project manager and director at North River, based in Portland and New York City, says goals for the project include revitalizing vacant and neglected mill space, filling the need for new and quality housing for people of all income levels, investing in and helping to improve the South End of the city and the nearby intersection, maintaining the historic integrity of the mills and building on the success of the adjacent Hathaway Creative Center.

North River commissioned a market study of Waterville’s real estate market that shows a strong need for new family rental housing in the city and surrounding region, according to Monks. She said 45% of the housing stock is 55 years or older and that this year, 2019, the demand is for about 460 units. Current absorption rates estimate the mill project will be 95% stabilized within seven months of the project completion, according to Monks.

Monks said Friday in a telephone interview that phase one of the project, totaling $21 million, would include developing 65 residential rental units, a third of which would be market rate and two-thirds workforce housing. The remaining 67 apartments would be included in a second phase of development.

Phase one would include all of the former Central Maine Power Co. building and the western side of the former Marden’s building, which is closest to downtown. Building amenities would include a gymnasium, community rooms, resident and bicycle storage, covered parking and laundry facilities. North River officials are discussing putting housing in the rest of the former Marden’s building as part of the second phase of development, but they have not made decisions on that phase yet, according to Monks.

North River plans to apply for Maine Housing tax credits. More than half of the $21 million total for phase one would be in the form of affordable housing tax credits and the company also will apply for state and federal historic tax credits, as well as Environmental Protection Agency Brownfield funding.

North River must show Planning Board approval of the project in order to apply for tax credits, according to Monks.

Market rate means there are no parameters on what North River can charge for rental units; workforce housing is significantly discounted rents offered for residents who make 50% to 60% of the area median income. Donegan said workforce housing is geared toward people who work in areas such as civil service, police, firefighters, teachers, retail and so on.

The monthly market rate rent for a one-bedroom unit would be $975 to $1,175; for a two-bedroom, $1,200 to $1,400; and three-bedroom, $1,400 to $1,600.

For one who earns 60% of the area median income, the rental cost for a 1-bedroom would be $800 to $850; two-bedroom, $900 to $950; and three-bedroom, $1,000 to $1,050. For one who earns 50% of the area median income, the cost for a one-bedroom would be $600 to $650; two bedroom, $750 to $800; and three-bedroom, $900 to $950.

North River bought the former KFC building across Water Street from the mill buildings and plans to demolish it and create parking spaces there.

Beverage said Thursday that the number of parking spaces needed for the redevelopment of both buildings is 220, according to requirements of the city’s Downtown Industrial Zone. Plans for the project include 96 spaces in front of the former Marden’s building closest to downtown at the intersection of Spring and Water streets, 13 spaces on Water Street in front of the former CMP, or middle building, 28 spaces inside that building, and 105 spaces on the former ball field lot leased from the city for a total of 242 parking spaces.

Parking for the two northernmost buildings is more than adequate to meet the standard in the city’s Zoning Ordinance, according to Beverage.

North River bought 6 and 8 Water St. for $1.5 million.

The northernmost mill building, 6 Water St., was used by Marden’s Surplus & Salvage after the C.F. Hathaway & Co. shirt factory closed. The middle building, 8 Water St., was used by Central Maine Power Co. North River bought the Hathaway Creative Center from Paul Boghossian in 2017 for $20 million.

Boghossian had renovated the former C.F. Hathaway & Co. shirt factory into retail and commercial offices with 67 high-end apartments on the upper floors.

The adjacent buildings at 6 and 8 Water St. comprise 182,000 square feet of space and sit on about 3.27 acres. The entire mill complex, including Hathaway Creative Center, is 412,000 square feet and overlooks the Kennebec River.

North River is a real estate investment, development and management firm that owns and operates more than 3.75 million square feet of mixed-use properties and more than 275 acres of ground-up development in Maine, Massachusetts, Vermont, New Hampshire, New York, Pennsylvania, Maryland, Colorado and California.

The company and its affiliates have closed on more than 30 transactions over the past 40 years, representing $1.6 billion in aggregate transaction volume, according to literature North River issued to the city.

The company specializes in brick and beam mill conversions and owns and operates not only Hathaway Creative Center in Waterville, but also Fort Andross Mill in Brunswick and Merrill’s Wharf in Portland.

In the late 1800s, the Lockwood Mills manufactured cotton. In 1881, Hathaway started producing shirts in the 10 Water St. building and closed operations in 2003.

Send questions/comments to the editors.

Comments are no longer available on this story