Concern about rising flood insurance premiums for historic districts on waterways has spurred the nonprofit group Maine Preservation to include the city of Gardiner’s downtown on its annual list of the state’s most endangered historic properties.

The listing was met with apprehension by the head of the leading downtown organization, who worried about being singled out, even while acknowledging the difficulty of the flood insurance problem. Gardiner officials have been trumpeting downtown revitalization efforts in recent years, pointing to more downtown events, new businesses and waterfront improvements.

Patrick Wright, executive director of Gardiner Main Street, said he was a little hesitant about Gardiner — with a downtown along the Kennebec River — being named as the poster child for the issue because it affects all downtowns on a floodplain.

“I hope it doesn’t attach any stigma because it is a statewide, national issue,” Wright said. “My hope is that it gets the attention of our congressional delegation so they can bring some legislation forward that makes some more sense and protects our historic properties.”

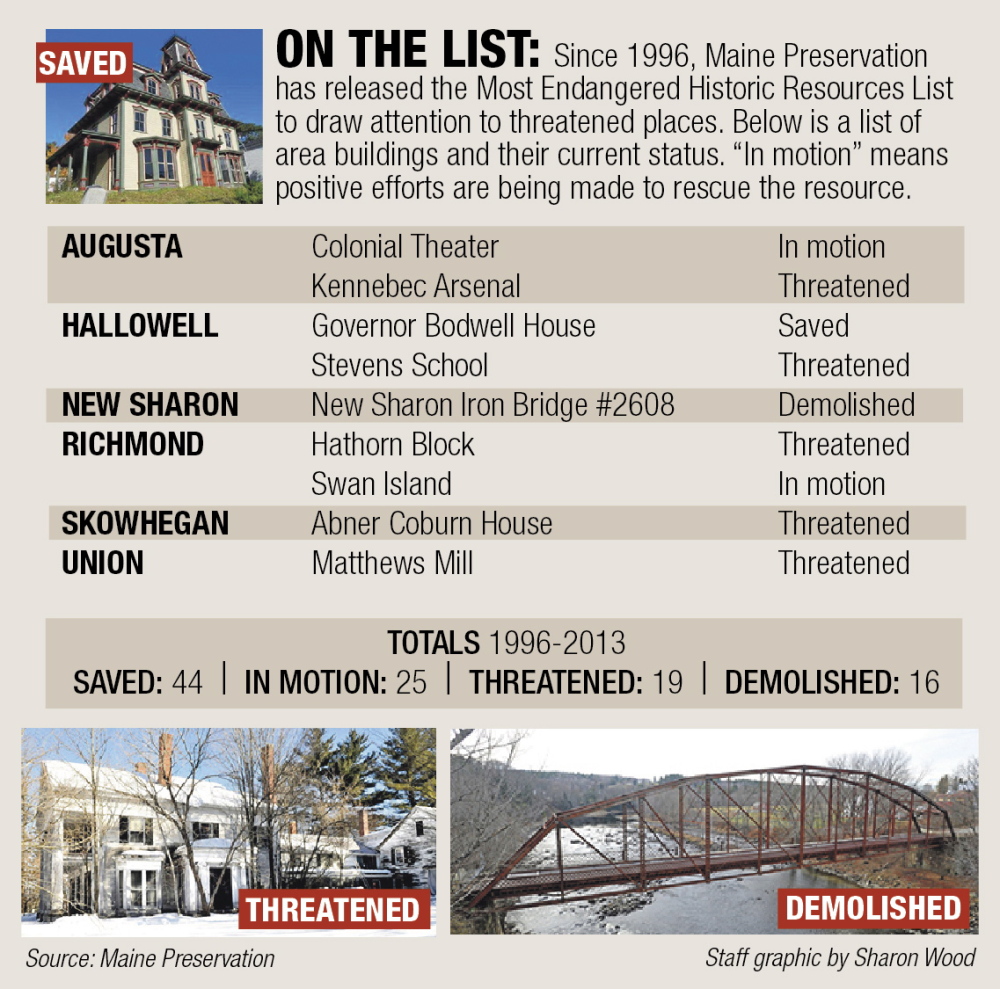

The Yarmouth-based organization’s annual Most Endangered Historic Properties List, the latest released Tuesday, attempts to raise the profile and awareness of threatened properties in need of preservation. Since the organization first published the list in 1996, 44 properties have been saved, 25 are in the process of being saved, 20 are still threatened and 15 have been demolished, according to Greg Paxton, executive director of Maine Preservation.

Paxton said the organization chose downtown Gardiner because it wanted to call attention to the issue of increasing flood insurance premiums in all historic downtowns on floodplains. Following an overhaul of the federal flood insurance program two years ago, homeowners and other building owners along the coast and in floodplains across the country saw massive increases to their flood insurance premiums.

Part of the law passed in 2012 to make the flood insurance program more financially sustainable removed many subsidies for older buildings built before floodplain regulations. Changes to the law passed this year returned some insurance subsidies for older buildings, but the Federal Emergency Management Agency still plans to phase out the subsidies slowly.

The Kennebec Journal reported in May that at least two real estate sales in downtown Gardiner fell through this year because of high flood insurance premiums caused by the 2012 law, which moved buildings to the full-risk rate when sold.

In one case, a Water Street building with a $2,700 annual premium in 2012 saw the price jump to $26,000 for a prospective buyer. Even though amendments to the law passed earlier this year reduced the rate to $2,200 a year, the rate still is expected to increase annually until it reflects the actual risk.

Wright, the executive director of the downtown Gardiner revitalization organization, said he would like policy changes that allow for some exceptions to the increases for properties and districts on the National Register of Historic Places, such as Gardiner’s downtown. He said he is working with other groups, including Maine Preservation and the Maine Downtown Center, to educate the state’s congressional delegation about these challenges facing historic downtowns near waterways.

He also said the groups are trying to determine what effect floodproofing the buildings will have on the insurance premiums, and they’re actively looking for funding sources to assist property owners in doing so.

“The policy, in effect, if it isn’t changed, will put us on a course such that the economic situation of owning historic buildings is very difficult,” Wright said.

Since the recent changes went into effect May 1, Wright hasn’t heard of any increases in premiums in downtown Gardiner. However, he said an official with the federal flood insurance program told him that building owners should expect increases of around 20 percent annually in the future.

“The fact remains that we don’t know what we’re going to be facing except for the short-term spike, which gave us a peek of where they’ll eventually get to,” Wright said.

FEMA said in a guide for business published in July that all nonresidential properties will receive no more than 18 percent annual increases starting Oct. 1 until the agency can determine how best to separately classify businesses.

Nate Rudy, director of economic and community development for Gardiner, said he doesn’t know if concerns about the future of flood insurance costs have led to any more real estate deals downtown to fall through, but he said the uncertainty has complicated a couple of real estate investments.

“The rate fluctuations have created some question marks for real estate investors, and until they know for sure what the rates will be and can factor that into their economic analysis, it’s very hard for them to make long-term commitments to a building,” Rudy said.

Also on the 2014 “endangered” list are Sewall Mansion in Bath, the Anson Town Office, the Abijah Buck House in Buckfield, the Lincoln Mill clock tower in Biddeford, the Biddeford City Hall clock tower, the Skowhegan Drive-In Theatre and the Belfast Opera House.

Paul Koenig — 621-5663

Twitter: @paul_koenig

Copy the Story LinkSend questions/comments to the editors.

Success. Please wait for the page to reload. If the page does not reload within 5 seconds, please refresh the page.

Enter your email and password to access comments.

Hi, to comment on stories you must . This profile is in addition to your subscription and website login.

Already have a commenting profile? .

Invalid username/password.

Please check your email to confirm and complete your registration.

Only subscribers are eligible to post comments. Please subscribe or login first for digital access. Here’s why.

Use the form below to reset your password. When you've submitted your account email, we will send an email with a reset code.